Rebuilding your credit might feel like watching paint dry, but don’t worry, it’s not impossible!

The time it takes to see results depends on your situation and the specific events that damaged your credit.

But here’s the good news: you have the power to take action and start rebuilding your credit right now.

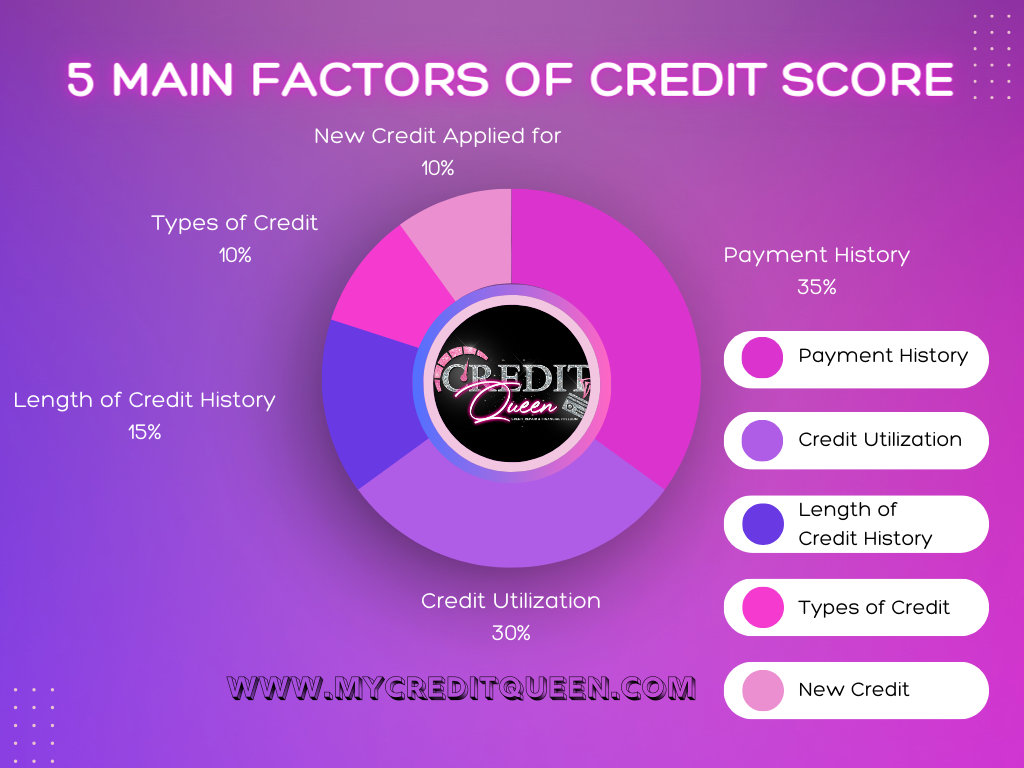

Let’s break down the factors that influence your credit score.

There are five categories, each with its own set of attributes.

Payment History

First up, payment history (35%). Making your payments on time is a big win for your credit, while missing payments can be a bummer.

The longer you wait, the more it can mess up your credit.

And hey, other negative marks like charge-offs and bankruptcy fall into this category too.

Current Debt

Next, we have current debts. The amount you owe compared to your initial loan amount can impact your credit.

Credit Utilization Ratio

But the real star here is your credit utilization ratio (30%). Keep it low by using only a small percentage of your credit card limits.

Trust me, keeping those balances far from your credit limits is a smart move. And if you can swing it, paying your bill in full every month is a killer way to avoid paying interest. Cha-ching!

Length of Credit History

Now, let’s talk about the length of your credit history (15%). The longer you’ve been responsibly managing your credit accounts, the better it looks for your credit scores.

So those old and new accounts, as well as the average age of all your accounts, really matter.

Credit Mix

Having different types of accounts in your credit report (10%) is another plus. Show off your skills with both revolving credit (like credit cards) and installment credit (like auto loans or mortgages). Having only one type of account is so yesterday.

New Credit

Last but not least, are recent credit applications. Applying for new credit (10%) can have an impact on your credit, so be mindful of how often you’re hitting that “apply” button.

How long do negative marks stay on my credit report?

Speaking of negative marks, let’s discuss how long they stick around.

Unfortunately, they can linger on your credit report for quite some time. Most accurately reported negative marks hang around for seven to ten years. Ouch!

These long-term effects can weigh down your credit scores because those smarty-pants credit scoring models use your report to do their calculations.

To give you an idea, here’s how long some of those costly negative marks stay on your report: late and missed payments, collection accounts, and Chapter 13 bankruptcy stick around for seven years.

But Chapter 7 bankruptcy? A whole decade. And credit inquiries? They loiter for a couple of years. See below:

- Late and missed payments: 7 years

- Collection accounts: 7 years

- Chapter 13 bankruptcy: 7 years

- Chapter 7 bankruptcy: 10 years

- Credit inquiries: 2 years

Don’t lose hope though.

While their impact decreases over time, negative marks can still affect your scores throughout their stay on your credit history.

The only exception is those hard credit inquiries, which only affect your FICO score for the first 12 months, even though they hang around for two years on your report. Sneaky, right?

So, what can you do to rebuild your credit?

I’ve got a few steps for you.

First, check your credit and dispute any inaccuracies or fraudulent information. Get the lowdown on what’s hurting your score and how to improve it.

Next, pay your bills on time. This is a biggie. Pay special attention to bills that get reported to the credit bureaus, like loans and credit cards.

Not only that, but you can also use FreedomPath’s credit repair platform to get credit for on-time payments that don’t typically help your credit.

We’re talking about payments for phone bills, rent, utilities, and streaming services. Ka-ching!

If high credit card balances are dragging your score down, paying them off can give your credit a major boost.

Even if you can’t pay them off completely, consolidating your credit card debt with a personal loan can lower your utilization rate. Just make sure it makes financial sense for you.

Another tip is to consider using a credit-building account. If you don’t have any accounts that are being reported to the credit bureaus, a secured credit card or credit-builder loan could be a game-changer for you.

Remember, rebuilding your credit takes time. It’s like a marathon, not a sprint.

Focus on what you can control, like paying down debt and adding positive information to your credit. Eventually, you’ll start to see those scores rise.

You’ve got this!

Yup, you guessed it. Sometimes I throw in those magical affiliate links that can whisk you away to credit utopia. But wait, there’s more! Each time you click on one of these bad boys and decide to snag a deal, a tiny trumpet-playing squirrel delivers a small bag of gold coins to our castle. In other words, I might earn a little something-something. Just know that I would never use a link that I don’t personally use myself and/or highly recommend.

About the Author

Meet Ashley Effinger, the Credit Queen and FreedomPath Advisor! Digital marketing royalty, I’m all about conversions and changing lives! By day, I improve credit scores, learn budgeting tricks, and build lasting wealth with my guidance. By night, I’m a rockstar wife and a supermom of 5 amazing kiddos! When not slaying credit myths, I indulge in my passions: reading, jet-setting, and sipping smoothies! Follow me for credit tips and a dose of laughter!

Drop me a line (say hi, ask a credit repair question, fan out, etc.): badcreditisexpensive@gmail.com

Ready to get started fixing YOUR credit? ashley@mycreditqueen.com

Let’s Connect on  Social

Social

LinkedIn: Ashley Effinger

Pinterest: @badcreditisexpensive

Instagram: @badcreditisexpensive

Youtube: @BadCreditIsExpensive

Twitter: @creditqveen

Facebook: @badcreditisexpensive

TikTok: @badcreditisexpensive

Medium: Ashley Effinger | Subscribe

Always valuable information…

Thank you so much Troilus! I really appreciate you stopping by and glad you found the information useful.