So, you’ve got a credit score. But what does that number really mean? And how does it impact your financial freedom? Let’s break it down, shall we?

Credit scores are like a translator for lenders. They help financial institutions, landlords, and utility companies gauge the level of risk they’re taking on by doing business with you. A high credit score is like a glowing stamp of approval, signaling that you’re a responsible, low-risk borrower.

On the flip side, a lower score suggests a potential risk.

But what happens when your score tumbles to the abyss of “extremely low”?

Well, let’s just say it’s not a good look. Lenders might be less inclined to lend you that much-needed cash, landlords might hesitate to hand over the keys to that apartment you’re eyeing, and utility companies could slam you with a hefty deposit. Yikes!

On the other hand, a higher credit score opens doors to lower interest rates, reduced fees, and smaller security deposits.

In fact, even the tiniest dip in your interest rate can save you a boatload of money over the life of a loan. So, it definitely pays to have a high credit score in your corner.

At the end of the day, understanding where your credit score falls on the scoring range can empower you to take control of your financial future. So, let’s get acquainted with those numbers and make smart choices that’ll have lenders begging to do business with us (instead of the other way around!).

Deep dive into the credit scoring models

Let’s talk about credit scoring models in a more exciting way. So, credit scores, you know, those three-digit numbers that can make or break your financial life?

Yeah, they’re calculated using these fancy computer programs called scoring models. These models analyze your credit report, which is basically a record of your borrowing and repayment history, provided by the credit bureaus.

Now, these scoring models are like detectives, searching for patterns in your credit data that suggest you might be a risky borrower. They look for clues that point towards payment defaults and use them to assign you a score. The higher the score, the less risky you appear to be compared to other borrowers. It’s like a secret agent ranking system for your finances!

But here’s the thing, different companies have their own versions of these scoring models. It’s like having different flavors of ice cream.

You’ve got the classic FICO Score and the trendy VantageScore. And just like there are different flavors, there are also different versions of these models. It’s like upgrading from Windows 10 to Windows 11 or from Android 10 to Android 11.

Oh! I almost forgot!

There are also specialty models designed for specific industries. It’s like having a secret agent that specializes in a particular mission. Pretty cool, right?

Now, when comparing credit scores (because we all love comparing ourselves to others), or tracking changes in your score over time, you need to make sure you’re comparing apples to apples (or scores to scores, in this case). So, here’s what you should know:

1. Which scoring model was used to calculate your score.

2. The version number of that model.

3. The highest and lowest scores possible with that model.

4. And the credit bureau that provided the credit report used to calculate your score.

Oh, and by the way, the law says that whenever you receive a credit score, that information has to be included.

So, the next time you hear someone talking about credit scoring models, you’ll be armed with all this cool knowledge. Keep it in mind and conquer the world of credit!

Ready to dive into the world of credit scores and ranges?

It’s like trying to figure out what to wear outside without knowing if it’s freezing or scorching hot. The range matters, my friend. Let’s take a closer look at a credit score of 700.

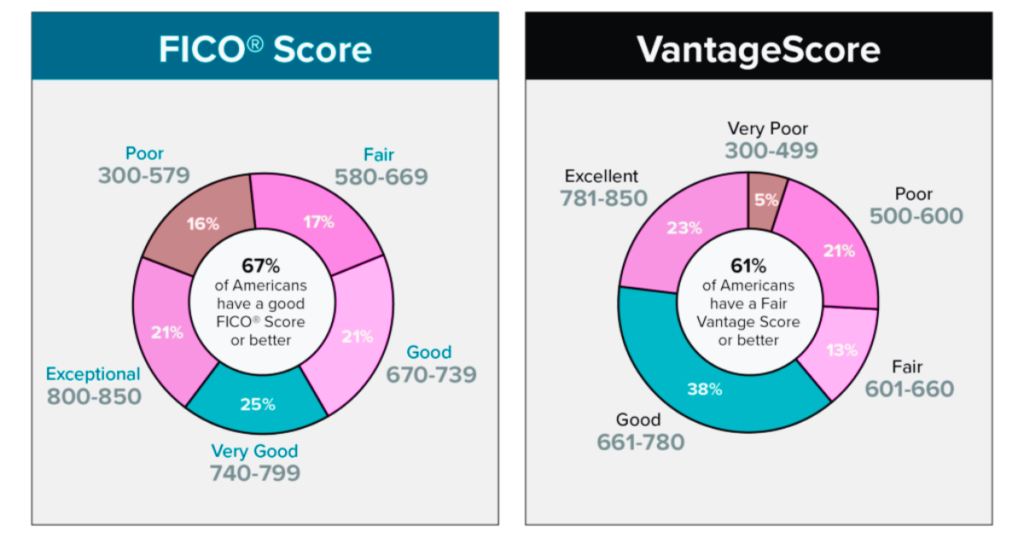

On the popular FICO score range, which goes from 300 to 850, a 700 is considered “good credit.” Yay, you! This means you’re eligible for all kinds of loan offers.

And guess what?

A whopping 90% of top lenders use FICO Scores, so you can trust that it represents how they see your creditworthiness.

Now, let’s talk about the competitor

VantageScore Solutions LLC also uses a scale from 300 to 850, but their models are a little different. With a VantageScore 3.0 or 4.0, a score of 700 is still good, but it leans more towards fair. Keep that in mind.

But wait, there’s more!

Did you know? We have special credit scores just for auto financing and credit card payments

The FICO Auto Score ranges between 250 and 900, with higher scores indicating lower risk. And the FICO Bankcard Score is similar, also ranging from 250 to 900.

Now, let’s talk mortgages

When it comes to buying a home or refinancing, mortgage lenders rely on specific versions of the standard FICO Score. These scores range from 300 to 850 and have names like FICO Score 2, FICO Score 5, and FICO Score 4. They’re used because Fannie Mae and Freddie Mac, the big players in the mortgage market, require them.

So, you want to know what “good credit” really means?

Well, buckle up, because we’re about to dive into the wonderful world of lending!

Here’s the deal: lenders want to lend money to people they know will actually pay it back.

Shocking, right? If they trust that you’ll be responsible with your debts and make those payments like a champ, they’ll call you a low-risk borrower with “good credit.”

On the flip side, if they have reason to believe you’ll flake out on your debts because of a history of poor money management, they’ll label you as a high-risk borrower with “bad credit.” Ouch.

But don’t worry, most of us fall somewhere in the middle. We’re not credit superstars, but we’re not total disasters either. That’s where credit scores come in. They help lenders figure out just how risky we are when it comes to borrowing money.

Now, here’s the juicy part: different lenders have different requirements. Some will only touch those with the squeakiest clean credit records, while others are willing to take a little risk for a higher payoff. They might charge you higher interest rates and fees, but hey, at least they’re giving you a chance, right?

Here’s the kicker: a small change in your credit score isn’t a big deal in most cases. If it’s just a few points up or down and you’re already rocking a killer credit score (think 800+), it won’t make a dent in your loan or credit card applications. But if that change drops your score below a lender’s minimum requirement, they might just slam that door shut on your face.

But have no fear, folks!

Credit scores aren’t set in stone. They’re like those cheesy photobooth pictures you take with your friends – just a snapshot of a moment in time. You can actually improve your credit score and level up like a pro! Use nifty tools, like FreedomPath, to add your on-time rent, phone, and utility payments to your credit history, instantly boosting your score. Or kick some credit card debt to the curb and watch those numbers soar.

Remember, credit scores are a reflection of your credit history – the good, the bad, and the ugly. But fear not, my friends! By making smart credit decisions today, you can create a bright and beautiful credit future. And that means higher credit scores and better opportunities to borrow like a boss.

What is the secret sauce to calculating credit scores?

Now, the secret sauce behind calculating those scores is closely guarded by FICO and VantageScore.

But here’s the deal – both use the same data from your credit report.

And guess what?

That data directly reflects the choices you make when you borrow and repay money. So, it’s kinda important.

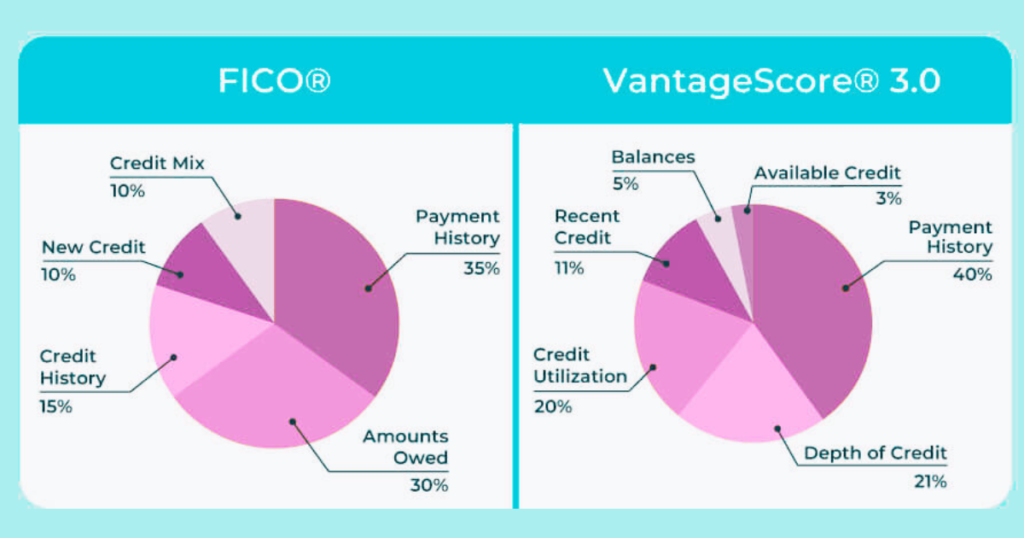

Fair Isaac Corp., the genius behind FICO Score, says these factors matter the most when it comes to calculating your score:

1. Payment history: Paying your bills on time is a biggie. It can make up to 35% of your FICO Score. So, better be prompt, my friend.

2. Credit utilization: Don’t go crazy with your credit cards, okay? Experts recommend using no more than 30% of your credit limit. Exceeding that may bring down your score. We don’t want that.

3. Length of credit history: Time is on your side, my friend. FICO Scores tend to increase over time. So, newbies, don’t fret! Keep making those timely payments, and your credit history will stretch out in the most fabulous way.

4. Credit mix: Variety is the spice of life…and credit scores! The FICO Score loves to see a mix of loan types, like installment credit and revolving credit (hello credit cards). Show off those different credits and influence up to 10% of your FICO Score.

5. Recent credit applications: Applying for a loan or a credit card can be like a little dip in your credit score roller coaster. Those hard inquiries may cause a slight drop, but don’t worry! As long as you keep being responsible and paying your bills, your score will bounce back. Checking your own credit score is a gentle inquiry, so go ahead and give yourself a pat on the back for being proactive.

6. Derogatory information: Ah, the not-so-pretty stuff. Some entries in your credit report can seriously bring down your score for a while. We’re talking collections, foreclosures, and bankruptcies. They’re not found in everyone’s report, but when they make an appearance, they become part of your payment history and can really drag down your score. Ouch.

Now, VantageScore has a slightly different take on things. Here’s what they prioritize:

- Payment history: Paying your bills on time is still at the top. Good job, you responsible person, you.

- Age and type of credit: The longer and more diverse your credit history, the better. So mix it up, my friend!

- Percent of credit limit used: Keep things balanced, okay? Using too much of your credit limit can hurt your score. So, don’t go maxing out those cards.

- Total balances and debt: Debt is no one’s best friend. Keep it in check and be wise about your balances.

- Recent credit behavior and inquiries: Applying for new credit can have a small impact, so be mindful of how often you do it. And remember, open only the credit accounts you actually need.

Oh, and VantageScore 4.0 is not a fan of certain collections accounts related to medical debt. It kindly ignores them.

Now, while FICO and VantageScore may not see eye to eye on everything, they both want to identify responsible credit users. So, if you adopt good credit habits and stick with them, all your credit scores will start to shine.

More deets to think about

If you are a new credit user! Don’t fret if your credit score is on the lower side. It’s not your fault, it just means that lenders prefer borrowers with a solid credit history.

But fear not, as long as you pay your bills on time and keep your credit card balances low, your score will gradually increase over time.

Want a foolproof way to ensure timely payment?

Set up autopay on your credit accounts and never miss a beat. Just remember, there’s no magic trick to speed up the process, but you can definitely mess it up if you’re not careful. So, play it safe!

Now, here’s a little secret for you: Lenders don’t solely rely on credit scores when making lending decisions.

Nope, they also take into account your income, length of employment, and any savings or assets you have.

They want to see if you can actually pay back the loan, ya know?

So, don’t stress too much about that three-digit number.

The real reason that credit scores from the three credit bureaus differ

As mentioned earlier the scores from Experian, TransUnion, and Equifax can be different.

Yep, these credit bureaus receive monthly reports about your credit usage from lenders, but the timing of those reports can vary.

So, your credit files at each bureau may not be exactly the same. That means there might be a little discrepancy in your scores. It’s not uncommon to see a difference of 20 points, and sometimes it can be even wider.

Now, here’s a fun twist: some lenders actually pull scores from two or even all three bureaus when they’re considering credit applications.

Why?

Well, there are no set rules, but those who pull two scores usually go with the lower one in their decision-making. Meanwhile, those who pull three scores tend to consider the middle score. Just a little insider tip for you!

Credit Scores: What Do They Really Mean?

Let’s talk credit scores. You know, those numbers that determine whether you’ll be showered with love from lenders or left in the dust with high interest rates and limited options.

But fear not!

I’m here to break it down for you in a way that actually makes sense.

- First up, we’ve got the rockstars of credit scores: the Exceptional. Scores between 800 and 850 fall into this category, and let me tell you, life is pretty sweet for these folks. Easy approval processes, the best lending terms, and the lowest interest rates and fees? Sign me up!

- Next, we have the Very Good crowd. Scores between 740 and 799 may not be exceptional, but they’re still pretty darn good. These people can expect better interest rates and some sweet deals from lenders. Not too shabby!

- Moving on to the Good group. If your score falls between 670 and 739, you’re in good shape. You may not have bragging rights, but lenders see you as an “acceptable” borrower. You’ll qualify for a range of loans and credit cards, but you might have to deal with slightly higher interest rates.

- Now, things start to get a little dicey with the Fair bunch. Scores between 580 and 669 are considered fair, but beware. Mainstream lenders might turn their noses up at you, and you could be slapped with higher interest rates. Not exactly the royal treatment, but you can still find some options out there.

- And finally, we have the Poor souls. Scores between 300 and 579 fall into this category, and it’s not exactly a party. Lenders may not want anything to do with you, and you could be limited to secured credit cards and hefty security deposits. It’s a tough spot to be in, but don’t worry, there’s still hope.

Now that you know where you stand, it’s time to make moves. Improve your credit score and unlock a world of possibilities! Start by paying your bills on time and keeping your credit card balances below 30% of their limits. And don’t forget to check your credit reports regularly to stay on top of any funky business.

Speaking of credit reports, did you know you can check them for free once a year?

Yep, head on over to AnnualCreditReport.com and get all the juicy details.

But why stop there?

With FreedomPath, you can monitor your credit score and report anytime you want. Plus, you’ll receive alerts for any sketchy activity that could be a sign of identity theft. Now that’s what we call peace of mind.

So, what are you waiting for?

Take control of your credit score, and watch your borrowing options and opportunities grow. It’s time to step up your credit game and make those numbers work for you!

The bottom line

Now we know the importance of our credit score and how it can significantly impact our finances.

Taking control of your creditworthiness can truly be empowering; understanding where you fit in the credit scoring range can equip you to make smarter decisions when it comes to borrowing money and getting low-interest rates and fees.

So no matter what your current score is, it’s possible to win lenders over with smart decisions.

But now the question remains: do you have the credit you desire?

If so, share what has worked for you below in the comments – the more we share our success stories with each other, the more successful all of us will become.

If not, don’t fret just yet – there’s always room for improvement. So why not take a few minutes out of your day to calculate a budget, pull a free credit report annually from annualcreditreport.com and start working on boosting that score today?

Who knows, one day soon phrases like “multipronged strategy,” “debt attrition” and “cash back rewards” could soon become part of your everyday lexicon!