Picture this: you’re cruising through life, riding the waves of each paycheck, when suddenly, out of the blue, your car decides to transform into a money-devouring monster, your washing machine coughs out its last spin, or Murphy’s Law decides to play a little game.

Fear not, my financially intrepid friend, for the answer to your stress-filled conundrum lies in the magical realm of emergency funds.

Yes, you heard it right – a financial fortress that stands tall even when your cash flow is more unpredictable than a cat deciding if it wants to be in or out.

So grab your metaphorical financial toolkit because we’re about to dive into the exhilarating art of building a robust emergency fund while juggling life’s curveballs.

What’s the Hubbub About Emergency Funds, Anyway?

An emergency fund is your financial guardian angel, the silver lining when life hands you lemons – or, more likely, a car repair bill that could make your eyes water. It’s the money stash ready to rescue you from unexpected expenses, medical emergencies, job loss, or even those times when life throws you an epic surprise party (which might be fun, but the bills aren’t).

The Million-Dollar Question: How Much Should You Save?

Let’s address the elephant in the room: the elusive magic number for your emergency fund.

Many financial experts recommend stashing at least three to six months’ worth of living expenses.

I can already see your eyes widen – three to six months?!

But worry not, brave soul, for even saving a little can go a long way in the world of emergency funds. Start small, and add a smidgen more to your fund with each paycheck until you hit that magic number.

David vs. Goliath: Building an Emergency Fund on a Tight Budget

Living paycheck to paycheck doesn’t mean the emergency fund realm is off-limits. In fact, this is where the real adventure begins! Let’s break it down:

1. Budgeting Like a Pro: It’s time to give your expenses a good, old-fashioned inspection. Start by tracking every penny you spend for a month – even those impulse snacks from the vending machine. Identify areas where you can cut back, like subscription services you don’t use or dining out too much. Those saved bucks? Right into the emergency fund, they go.

2. Reducing the Clutter: Remember those unused gym memberships, magazine subscriptions, and cable channels you’ve been clinging to? It’s time to karate chop your expenses. Cancel what doesn’t spark joy (or at least financial sensibility) and redirect that money towards your superhero fund.

3. DIY to the Rescue: Have a leaky faucet or a shirt missing a button? Instead of reaching for your wallet, channel your inner handyman or seamstress. Embrace DIY solutions to save money on minor repairs and upgrades.

4. The Envelope Method: Have you ever tried the envelope method? Allocate a fixed amount of cash into labeled envelopes for various expenses like groceries, entertainment, and dining out. When the envelope is empty, your spending for that category is done for the month – no more swiping cards like a magician’s assistant!

5. Side Hustle Superpowers: In the gig economy, opportunities are aplenty. Use your skills or hobbies to dabble in part-time gigs or freelancing. The extra income generated can be your emergency fund’s sidekick.

Strategically Planning for Your Financial Kingdom

Behold the strategies that will turn your emergency fund into a mighty fortress:

1. Pay Yourself First: Treat your emergency fund like an essential monthly bill. Set up an automatic transfer on payday to ensure a portion of your earnings goes directly into the fund before you even have a chance to miss it.

2. The Windfall Wonder: Did you receive an unexpected bonus, tax refund, or gift? While a part of you might want to splurge, divert a healthy chunk of that windfall directly into your emergency fund. Think of it as a gift to your future self.

3. Level Up The Snowball and Avalanche Methods: Dealing with high-interest debt while building an emergency fund? Consider the snowball method (tackling small debts first for quick wins) or the avalanche method (attacking high-interest debts first for long-term savings). Clearing debts means more room for your emergency fund to grow.

4. The Forgotten Raise: Did you snag a raise or promotion at work? Don’t let your newfound income vanish into the ether. Instead, maintain your previous lifestyle and channel the extra income directly into your emergency fund.

5. Negotiation Ninja: Put on your negotiation cape and see where you can haggle for better deals – from your internet bill to insurance premiums. Each and every dollar saved is a dollar earned for your fund.

Why an Emergency Fund is Your Financial Wingman

Picture this: You’re hanging out with friends when an unexpected expense rears its ugly head. You, my savvy friend, remain as calm as a Zen master, thanks to your trusty emergency fund.

Here’s why it’s worth its weight in gold:

1. Stress-Buster Extraordinaire: Worrying about how to pay for sudden expenses? Say sayonara to sleepless nights and hello to the serenity that comes with knowing you’re financially prepared.

2. Bye-Bye Debt Drama: When emergencies strike, the last thing you want is to slide further into debt. An emergency fund keeps you afloat without resorting to credit cards or loans.

3. Job Jitters? No More: Job loss or unexpected unemployment won’t rock your world. Your emergency fund keeps your financial ship steady while you navigate the waters of job hunting.

4. Decision-Making in Peace: Have you ever made a rushed decision due to financial pressure? When you have an emergency fund as your safety net, you can make thoughtful choices without the storm clouds of money worries overhead.

5. Financial Freedom is Yours: Dreams of a spontaneous vacation or pursuing a new hobby? Your emergency fund grants you the freedom to make choices that enrich your life without sacrificing your financial stability.

In Conclusion, Your Epic Adventure Begins

Life’s unpredictable nature can’t be tamed, but your finances can be prepared for the rollercoaster ride. By embracing the art of building an emergency fund while living paycheck to paycheck, you’re securing your financial future one smidgen at a time. Whether you start by saving a dollar or a hundred, the journey of a thousand miles begins with a single step. So, take that step, embrace the adventure, and let your emergency fund be the sturdy bridge that carries you through your life’s exciting and unpredictable chapters.

Remember, my fellow financial warrior, the game of life might be unpredictable. With an emergency fund as your trusty sidekick, you’re always ready for whatever curveball comes your way. So go forth, save fiercely, and conquer your financial fears with the mighty power of an epic emergency fund!

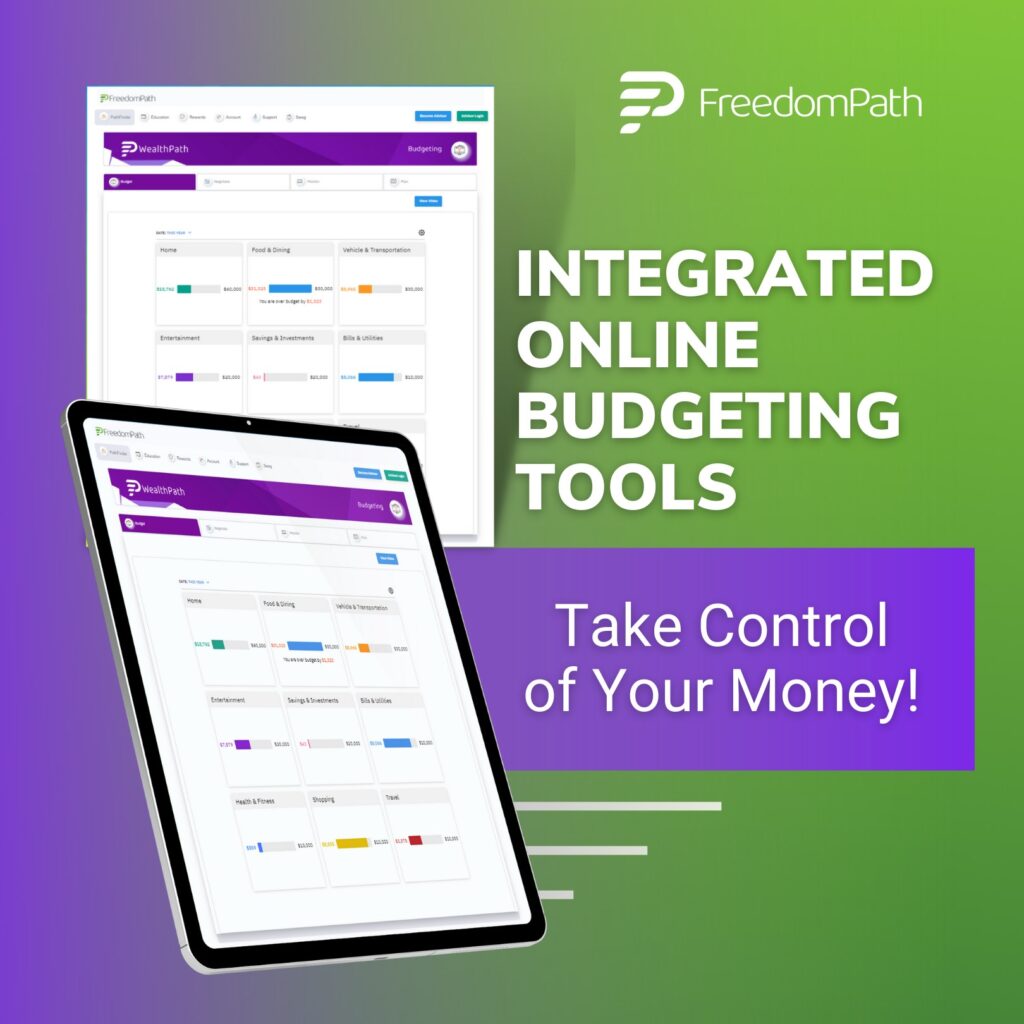

Need help budgeting like a pro? FreedomPath helps you keep your financial affairs in order, with an abundance of calculators to help you budget like you never have before!

Yup, you guessed it. Sometimes I throw in those magical affiliate links that can whisk you away to credit utopia. But wait, there’s more! Each time you click on one of these bad boys and decide to snag a deal, a tiny trumpet-playing squirrel delivers a small bag of gold coins to our castle. In other words, I might earn a little something-something. Just know that I would never use a link that I don’t personally use myself and/or highly recommend.