Want more spending power with your credit card? Want to manage your credit utilization more effectively? Well, it’s time to increase your credit limit! Don’t wait around for the card issuer to automatically raise it for you – take matters into your own hands.

So, how do you go about getting a credit limit increase?

It’s simple!

Just follow these steps:

1. Request an Increase Online or In-App

The easiest way to request an increase is through the card company’s website or mobile app. Just fill out the form and submit your information. Easy peasy!

2. Call Your Card Issuer

Give them a ring and ask for a credit line increase. Be prepared to explain why you need more credit, and provide details about your income and expenses. Sometimes, you’ll get approved on the spot, but it could take up to 30 days for your request to be processed.

3. Apply for a Second Credit Card

If all else fails, you can try applying for another credit card. But be cautious – this can affect your credit scores and means you’ll have another account to manage responsibly.

4. Update Your Income and Be Patient

Sometimes, your card issuer will review your income and account history and decide to automatically increase your credit limit. If they ask for updated income information, it’s a good sign that they’re considering it.

Does a credit limit increase affect my credit score?

Now, let’s talk about how a credit limit increase can impact your credit scores. It’s important to know that credit utilization plays a big role.

The general rule is to keep your ratio under 30%. For example, if you have a $5,000 balance on a credit card with a $15,000 limit, your ratio is 33.3%. But if your limit is increased to $20,000, your ratio drops to 25%.

Want to increase your chances of being eligible for a higher credit limit?

Here’s a few tips that can help you out:

First things first, make sure your financial and personal information is up to date. Credit card companies need accurate income information to consider increasing your credit limit. So check your account details at least once a year to keep everything current. They might ask for details like your income, employment status, and monthly mortgage or rent payment.

Next, pay your monthly statements on time. It’s a great way to show you’re responsible with credit. If you struggle with organization, consider setting up automatic payments or electronic reminders to avoid missing payments.

Here’s a pro tip: try to pay more than the minimum on your credit card bills. Not only will it save you money on interest, but it’ll also improve your credit utilization ratio.

It’s a win-win!

Another important step is to review your credit report for any errors. You can get free copies from the three major credit reporting agencies. Visit AnnualCreditReport.com to learn more and make sure all your information is correct. If you find a mistake, take action to correct it.

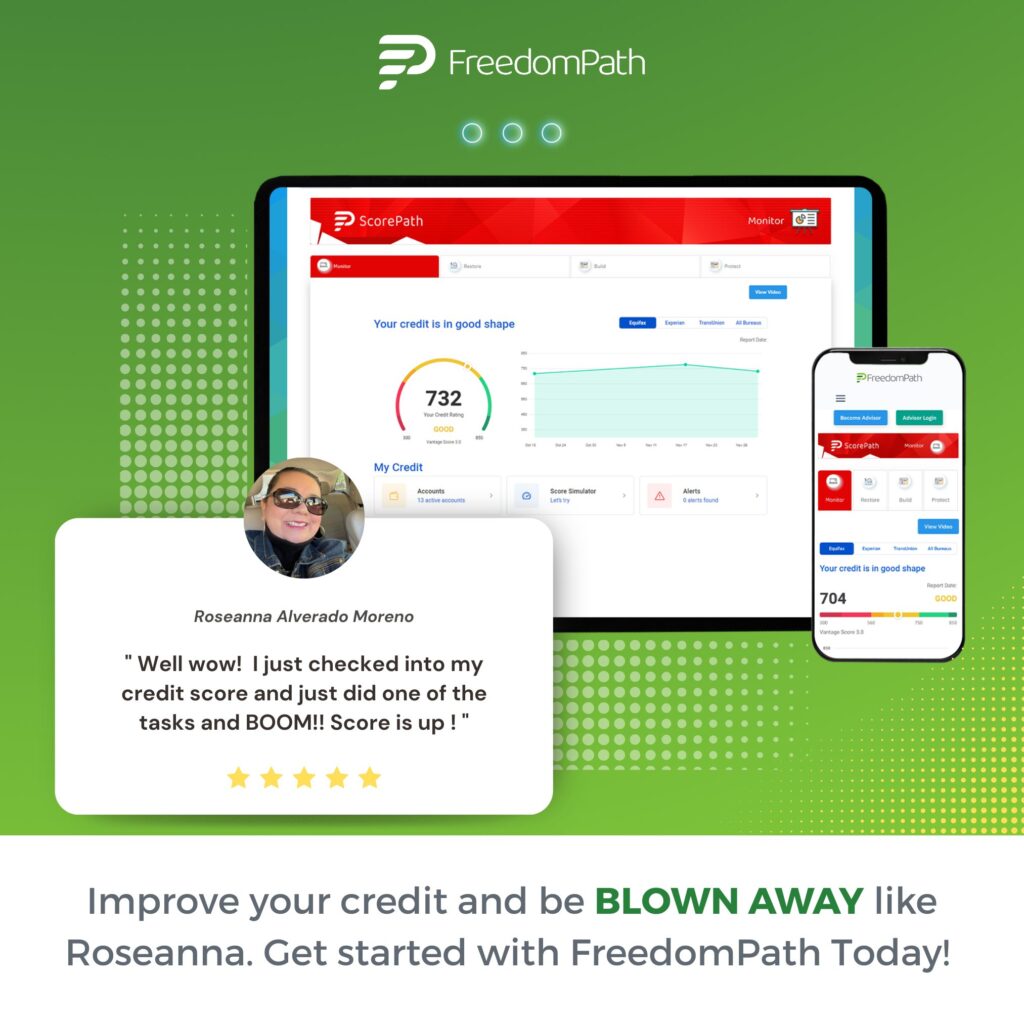

Lastly, keep a close eye on your credit with a tool like FreedomPath. It’s a great way to monitor your credit without hurting your scores. Plus, it’ll help you spot any potential fraud or errors on your report. You can even explore the impact of your financial decisions before making them.

Conclusion

Overall, there are pros and cons to increasing your credit limit.

On the bright side, you can make larger purchases without worrying, maintain a healthy credit utilization ratio, and be prepared for unexpected expenses.

However, be cautious of overspending and too many credit inquiries.

So, what are you waiting for? Take control of your credit limit and enjoy the benefits that come with it!

Follow these tips, and you’ll be on your way to increasing your credit limit in no time.

Happy credit building!