Get ready to have your mind blown, because we’re about to dive into the world of FICO credit scores.

These bad boys are the most widely used credit scoring model out there.

Like, seriously, 90% of top U.S. lenders use them for 90% of lending decisions. Talk about popular!

Alright, buckle up because I’m about to spill the tea on the FICO credit score. But before we dive in, let’s talk about where it all started.

How it all began

Back in 1956, engineer Bill Fair and mathematician Earl Isaac got together and founded Fair Isaac.

These guys were ahead of their time, and their company holds a whopping 200 patents (184 in the U.S. and 16 overseas) for their fancy technologies. And get this, they’ve got another 102 patents pending. They’re on a roll!

Who really uses FICO credit scores?

Now, here’s where things get interesting. Ninety-five percent of the big shots in the U.S. financial world are clients of FICO.

They’ve even sold over 100 billion credit scores since they started. That’s billion with a B!

And get this, about three-quarters of all home loans use the info provided by FICO scores and reports. They’re the real deal!

But they’re not just about helping businesses. Nope, FICO cares about regular folks like you and me too.

Through their consumer division called myFICO, you can actually access your own credit scores. It’s like peeking behind the curtain of your financial life. How cool is that?

Having FICO adds an added layer of protection

And let’s not forget about the 2.5 billion credit cards they protect from fraud with their amazing fraud protection service. They’re like superheroes, saving the day one credit card at a time.

So basically, FICO is all about making it easier for businesses to assess your credit risk, which in turn gives us consumers more access to credit. It’s a win-win situation.

And let’s not forget, they make bank by selling credit scores to both businesses and individuals. It’s a big part of their business model.

Now you’re in the know, my friend. The FICO score is a game-changer, and it’s here to stay.

FICO has many credit scoring models

So here’s the breakdown:

FICO has a few different score versions, but the most common one is FICO 8.

They’ve also got FICO 9 and this fancy thing called FICO 10 Suite (which includes FICO 10 and FICO 10T).

Plus, there are some older versions still floating around for specific lending situations.

How does FICO scoring work?

Now let’s talk about how these scores work.

FICO takes a look at your credit reports and crunches some numbers to come up with a score that lenders use to judge your creditworthiness.

Basically, it tells them if you’re a responsible borrower or not.

And the higher your score, the better your chances of getting approved for those sweet loans and lines of credit at the lowest interest rates. Cha-ching!

Now, you might be wondering how they calculate these scores.

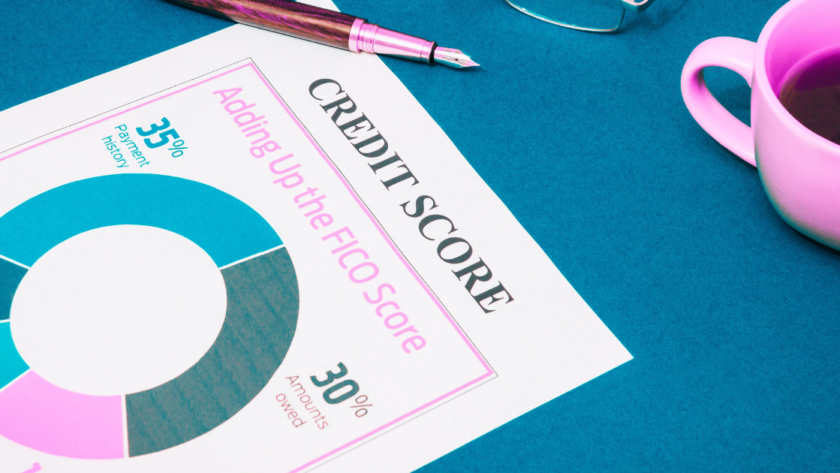

Well, there are five factors at play here:

- payment history

- amounts owed

- length of credit history

- new credit

- credit mix

Each of these factors has a certain percentage of weight in determining your overall score.

And get this, as mentioned above you can actually have more than one FICO score. There are different versions like FICO 2, FICO 3, FICO 4, and so on.

Each one is used in different lending situations.

For example, FICO 2, 4, and 5 are used by mortgage and auto lenders to determine if you’re creditworthy.

Right now, FICO 8 is the most common version and it’s used for things like auto loans, personal loans, and credit cards.

Oh, and one more thing…

You might have different scores from each of the three credit bureaus (Equifax, Experian, and TransUnion) because they each have their own reports based on what your creditors have told them. Just something to keep in mind.

What is a good FICO credit score?

Now, let’s talk about what a good credit score looks like.

FICO has different classifications, like exceptional, very good, good, fair, and poor. And depending on where your score falls, you’ll know how lenders see you.

For example, if you’ve got a credit score of 800 to 850, you’re in the exceptional range. You’re basically a credit legend, my friend.

But wait, there’s more!

What’s the most commonly used FICO score modeling version?

Let me introduce you to FICO 8. It’s like the rockstar of credit scores.

When you’re applying for a credit card or personal loan, chances are the lender is gonna be all about your FICO 8 score.

This version is unique because it takes into account things like:

- credit utilization

- late payments

- small-balance collection accounts

It’s all about those details, baby!

And get this, there are different versions of FICO 8 too.

Like, FICO Bankcard Score 8 focuses on your credit card history, while FICO Auto Score 8 doesn’t care as much about credit cards. Pretty cool, huh?

Thanks FICO 9, now there’s no need to be concerned about 3rd party collections

But wait, there’s more (again)! FICO 9 joined the game in 2016.

It’s not as popular as FICO 8, but it’s got some juicy features. Like, paid-in-full third-party collection accounts don’t have a negative impact on your score anymore.

FICO 9 gives breaks for unpaid medical bills

And unpaid medical collection accounts aren’t as bad as other types of unpaid accounts.

Plus, rental history can be factored into your score, which can be a game-changer if you’re new to credit (our DIY credit repair platform has this capability at your fingertips).

Oh, and fun fact: some lenders offer free access to your FICO 9 score.

So if you’re curious, you might be able to get your hands on it without spending a dime.

A closer look at FICO 10 and FICO 10T

Let’s dive into the world of FICO 10 and FICO 10T. These new scoring models are making waves in the industry, giving lenders a clearer and more accurate picture of your credit risk.

But what sets FICO 10T apart?

Well, it takes into account your credit patterns over the past 24 months or longer, considering factors like carrying a balance and consolidating debts. Talk about thorough!

FICO isn’t the only game in town

Now, while FICO scores may rule the roost, there is some competition in town – VantageScore.

Don’t worry, we won’t hold it against them.

VantageScore, like FICO, calculates scores using your credit report but weighs factors a little differently.

And guess what?

Some companies, like American Express, even provide VantageScores to their customers for free. Nice!

How do you find out your FICO credit scores?

But how on earth do you actually find out your credit score?

Fear not, my friends. You can purchase it or snag a freebie from banks, credit card companies, and various websites. Just remember, you may have multiple scores, so don’t be surprised if they don’t all match up.

Where do you get a copy of your credit report?

And what about those credit reports?

Well, lucky for you, you’re entitled to see them once a year from all three major credit bureaus. Just head on over to AnnualCreditReport.com and dive right in.

But here’s the thing, folks – credit reports don’t actually show your credit score.

Say what?

Yep, it’s true. Your credit scores are based on the information in your reports, but they don’t make an appearance themselves.

Sneaky, huh?

You also have the option to sign up for FreedomPath, a DIY credit repair platform that displays all three scores on the dashboard, for easy monitoring. The platform also helps to build credit, create and manage your budget, build wealth at no additional cost.

The bottom line

So, in a nutshell, FICO scores are the bee’s knees when it comes to credit scoring, with multiple versions available.

And no matter which model you encounter, the same golden rules apply – pay your bills on time, keep that credit utilization ratio low, and go easy on applying for new credit. Show those scores who’s boss!

Now go forth and conquer the credit world, my friends!

I enjoy what you guys are usually up too. This sort of clever work and coverage! Keep up the wonderful works guys I’ve added you guys to my blogroll.

You actually make it seem so easy together with your presentation however I find this matter to be really something which I believe I’d never understand. It seems too complex and extremely wide for me. I’m taking a look forward to your next put up, I will attempt to get the grasp of it!