Want to know the secret to improving and maintaining your financial health?

Check your credit score regularly!

According to a study by Discover, 76% of people who checked their credit report at least seven times a year saw an improvement in their score. Plus, it helps you keep an eye out for any fraudulent activity or identity theft.

Now, let’s clear up the confusion between credit reports and credit scores. Your credit report contains info about your loans, payment history, addresses, employers, and more. But your credit score is a three-digit number that determines if you have “good” or “bad” credit. The higher the number, the better your credit is. The FICO score is the most widely used, used by 90% of lenders, but there are other models out there too.

So, how can you check your credit score regularly?

Here are some options:

1. Get it for free: Sign up for VantageScore credit score monitoring. It’s not the same as FICO, but it’s still helpful and widely used by companies that pull credit reports.

2. Purchase your FICO score: Yep, there’s a fee, but if you want the exact score your lender will use, i could be worth it (just keep in mind it’s not necessary though for most situations).

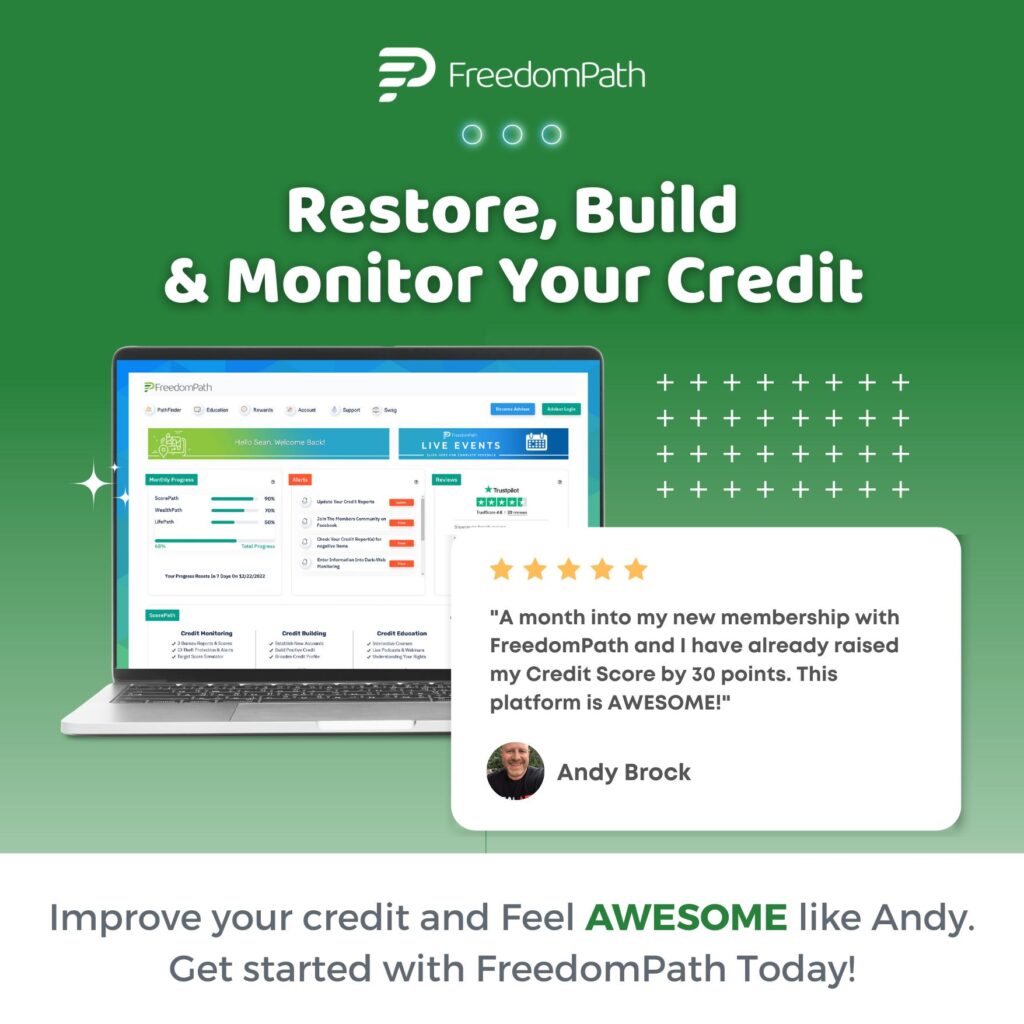

3. Join FreedomPath: As a member, with this DIY credit repair platform you can monitor your credit daily, for no additional cost (amongst many other things). Stay on top of things with their handy dashboard.

4. Use a credit service: Various services provide free reports based on data from all three credit bureaus. While not official scores, they’re pretty accurate.

5. Check your statements: Some credit card and loan companies are starting to put credit scores on monthly statements. Take a peek and see if yours is there.

6. Counselor or housing service: Non-profit credit counselors or HUD-approved housing counselors might offer a free credit score. Worth asking about if you’re already using their services.

And here’s the good news

If you have a negative report on your credit score, like a late payment, it won’t haunt you forever.

Late payments usually disappear after two years, while major factors like bankruptcies won’t affect your score after seven years (with a few exceptions).

So even if your score isn’t impressive now, with time and good habits, it can get better.

So what are you waiting for?

Start checking that credit score and take control of your financial future!