Hey there, savvy spenders! Today, we’re diving deep into the plastic jungle, exploring the wild world of credit and debit cards.

It’s a battle as old as time – or at least as old as the invention of credit cards.

So, let’s unravel the mysteries of these financial superheroes and decide once and for all: Credit cards or debit cards – which one should you wield?

The Basics

Let’s start with the basics. Credit and debit cards may look similar, but boy oh boy, they’re as different as night and day.

Credit Cards: The Spend-Now-Pay-Later Magic Wand

Credit cards are your financial fairy godmother, waving a magic wand that says, “Buy now, pay later.”

When you use a credit card, you borrow money from the card issuer and promise to pay it back at the end of the billing cycle.

Fail to do so, and you’ll be greeted with the not-so-magical spell of interest.

Debit Cards: Your Financial Bodyguard

On the other hand, debit cards are like your trusty sidekick, always there to protect your hard-earned cash.

With a debit card, you’re spending the money you already have in your bank account. No loans, no interest – just pure, unadulterated control over your funds.

Now that we’ve met our contenders, let’s throw them into the ring and see which one emerges victorious in various scenarios.

Scenario 1: Everyday Expenses

Credit Cards: Imagine this – you’re at your favorite coffee shop, eyeing that extra shot of espresso like it’s the elixir of life. Swipe your credit card, and you’re golden. Credit cards are fantastic for everyday expenses, earning you reward points, cashback, and maybe even a pat on the back from your financial advisor.

Debit Cards: Debit cards shine here too. They’re like your financial ninja, helping you stick to your budget and avoid the pitfalls of overspending. No bills haunting you at the end of the month – just zen-like peace of mind.

Scenario 2: Emergency Situations

Credit Cards: Picture this: Your car breaks down in the middle of nowhere. Thank the financial heavens for your credit card! It’s your knight in shining armor, ready to rescue you from unexpected expenses. Many credit cards offer perks like roadside assistance and purchase protection, turning emergencies into mere inconveniences.*

Debit Cards: Debit cards, while reliable, offer a different level of protection and perks than their credit counterparts. Your bank balance takes a hit immediately, and disputes can take longer to resolve.

*Please note: I strongly recommend building an emergency fund so you don’t have to use a credit card unless you can pay the entire balance off when or before your payment is due. Doing so will prevent having to pay interest fees. If you can not pay the credit card balance in full, use the money in your emergency fund (after all, you created it for emergencies!)

Scenario 3: Online Shopping

Credit Cards: Online shopping is the credit card’s playground. With robust fraud protection, your credit card acts as a shield against unscrupulous online merchants. Plus, if your purchase turns out to be a dud, you can often dispute the charge and have it reversed.

Debit Cards: While many debit cards offer online purchase protection, the process might not be as seamless as credit cards. If there’s a dispute, you might be temporarily out of funds until the issue is resolved.

Credit Cards vs Debit Cards: Pros and Cons Galore

Let’s break down the pros and cons of our contenders to help you make an informed decision.

Credit Cards

Pros:

- Rewards and Perks: Earn points, miles, or cashback on purchases.

- Build Credit History: Responsible credit card use can boost your credit score.

- Emergency Lifeline: Your financial safety net during unexpected expenses.

Cons:

- Interest Charges: Fail to pay your balance, and those interest charges can pile up.

- Temptation: The ease of spending can lead to impulse purchases.

- Fees: Annual fees and late payment fees – they can add up.

Debit Cards

Pros:

- No Debt: You’re spending your own money, so no worries about interest.

- Budget-Friendly: Helps you stick to your budget effortlessly.

- Widespread Acceptance: Accepted almost everywhere plastic is welcome.

Cons:

- Limited Rewards: Debit cards usually offer different rewards than credit cards.

- Overdraft Fees: Watch out for overdraft fees if you spend more than your account balance.

- Limited Fraud Protection: While improving, it might not match the robust protection of credit cards.

Credit Card vs Debit Cards Strategies and Solutions

Credit Cards: To master the credit card game, follow these strategies:

- Pay in Full: Avoid interest like the plague by paying your balance in full each month.

- Choose Wisely: Pick a credit card that aligns with your spending habits and goals.

- Monitor Your Credit: Regularly check your credit report for errors and identity theft.

Debit Cards: Maximize your debit card game with these tips:

- Track Your Spending: Stay on top of your transactions to avoid overdraft surprises.

- Use ATMs Wisely: Stick to in-network ATMs to dodge those expensive fees.

- Activate Alerts: Set up account alerts to receive notifications for large transactions or low balances.

Credit Cards vs Debit Cards Extra Tips and Tricks

Credit Card Hacks

- Utilize Introductory Offers: Many credit cards lure you in with enticing introductory offers, such as 0% APR for the first few months. Capitalize on these periods to make big purchases without incurring interest.

- Strategize Rewards: Understand the reward system of your credit card. Some cards offer better rewards for specific categories like groceries or travel. Align your spending to maximize these benefits.

Debit Card Savvy

- Opt for Cashback: Some debit cards offer cashback rewards for certain transactions. Check with your bank to see if you can earn a little extra every time you swipe.

- Set Spending Limits: Many banks allow you to set daily spending limits on your debit card. Use this feature to prevent overspending and stay within your budget.

Credit Building Wisdom

- Keep Credit Utilization Low: Aim to use only a tiny percentage of your available credit to maintain a healthy credit utilization ratio. This shows creditors that you can manage your credit responsibly.

- Diversify Credit Types: A mix of credit types, such as credit cards and installment loans, can positively impact your credit score.

Debit Card Security Measures

- Enable Two-Factor Authentication: If your bank offers two-factor authentication for online transactions, enable it. This adds an extra layer of security to protect your account.

- Regularly Update PINs: Change your debit card PIN periodically to minimize the risk of unauthorized access.

Credit Cards vs Credit Cards Addressing Common Concerns

Fear of Debt with Credit Cards

- Solution: Treat your credit card like a debit card. Only spend what you can afford to pay off in full at the end of the month. This way, you enjoy the benefits without accumulating debt.

Credit Score Anxiety:

- Solution: Your credit score isn’t a mysterious number; it reflects your financial habits. Regularly check your credit report, pay bills on time, and keep credit card balances low to maintain a healthy score.

Overdraft Nightmares with Debit Cards

- Solution: Set up overdraft protection with your bank. If you accidentally overspend, the bank will transfer funds from another account to cover the difference, saving you from hefty overdraft fees.

Mastering the Rewards Game: Credit Cards vs Debt Cards

Credit Card Points and Miles Mastery

- Strategic Redemption: Don’t let those hard-earned points gather dust. Research and strategically redeem them for maximum value. Whether it’s a free flight, hotel stay, or cash back, make your points work for you.

- Bonus Categories: Many credit cards have rotating bonus categories that offer higher rewards for specific purchases. Stay informed about these categories and adjust your spending to maximize your rewards.

Debit Card Budgeting Perfection

- Automate Savings: Use your debit card transactions to your advantage by setting up automated transfers to your savings account. Round up your purchases to the nearest dollar and watch those extra cents accumulate over time.

- Cash Envelopes: Adopt the old-school cash envelope system digitally. Allocate specific funds for categories like groceries and entertainment and use your debit card only for those expenses.

Credit Building Strategies

- Secured Credit Cards: If you’re building or repairing your credit, consider a secured credit card. These cards require a security deposit but can be a stepping stone to a traditional credit card when used responsibly.

- Authorized User Benefits: Piggyback on someone else’s good credit by becoming an authorized user on their credit card. This can positively impact your credit score as the primary cardholder’s positive payment history is reflected on your credit report.

Debunking Myths

Myth: Debit Cards Don’t Build Credit

- Reality: While debit card transactions don’t directly impact your credit score, responsible use of credit can still boost your financial profile. Consider alternative credit-building methods if a credit card isn’t your preferred route.

Myth: Credit Cards Are Dangerous

- Reality: Credit cards are tools, not villains. When used responsibly, they can be powerful allies in achieving financial goals. Don’t let fear prevent you from enjoying their perks and protections.

Navigating Travel with Plastic: Credit Cards vs Debt Cards

Credit Card Travel Benefits

- Travel Insurance: Many credit cards provide travel insurance, covering everything from trip cancellations to lost baggage. Before your next adventure, check your credit card benefits and travel stress-free.

Debit Card Travel Tips

- Notify Your Bank: Inform your bank of your travel plans to prevent your debit card transactions from being flagged as suspicious. Being stranded without access to your funds is not an ideal vacation scenario.

Staying Ahead of the Curve

Contactless Payments

- Credit Card Tap-and-Go: Embrace the convenience of contactless payments with your credit card. It’s fast and secure. You’ll look like a tech-savvy financial shopper.

- Debit Card Contactless Magic: Debit cards also support contactless payments. Enjoy the speed and security without reaching for your wallet.

Digital Wallets

- Credit Card Magic in Your Phone: Link your credit card to a digital wallet like Apple Pay or Google Pay for a seamless, secure, and futuristic payment experience.

- Debit Card in Your Digital Arsenal: Your debit card can also join the digital revolution. There is no need to carry a physical card – just tap your phone and go.

Environmental Impact

Credit Cards and Eco-Friendly Choices

- Paperless Statements: Opt for paperless statements with your credit card to reduce environmental impact. Many issuers offer rewards or discounts as an extra incentive.

Debit Cards and Green Living

- Eco-Friendly Banking: Choose a bank that aligns with your environmental values. Some banks are committed to sustainability and offer eco-friendly banking options.

Exploring Credit Card Annual Fees

Annual Fee Justification

- Evaluate Rewards and Benefits: Before dismissing a credit card with an annual fee, carefully assess its rewards and benefits. Sometimes, the perks, like airport lounge access or travel credits, can outweigh the fee.

Fee Waivers and Negotiation

- Negotiate with Your Issuer: Call your credit card issuer if you’re not thrilled about paying an annual fee. In some cases, they may be willing to waive the fee, especially if you’re a long-time, responsible cardholder.

Debit Card Security Reinforcements

Virtual Card Numbers

- Added Online Security: Some banks offer virtual card numbers for online transactions. These are temporary numbers linked to your debit card, adding an extra layer of security and preventing your actual card details from being compromised.

Mobile Banking Security

- Biometric Authentication: Many banks now offer biometric authentication in their mobile apps, such as fingerprint or facial recognition. Enable these features for an additional level of protection when accessing your debit card information.

The Cryptocurrency Connection

Credit Cards and Crypto Purchases

- Caution in Crypto: Using a credit card to purchase cryptocurrencies might seem tempting, but be cautious. Some credit card issuers treat these transactions as cash advances, which can come with high fees and interest rates.

Debit Cards and Crypto Wallets

- Direct Access: Some debit cards allow you to link them directly to a cryptocurrency wallet. This can provide a seamless way to spend your crypto holdings alongside your traditional funds.

Credit Card vs Debit Card: Handling Card Loss or Theft

Credit Card Protection Measures

- Zero Liability Protection: Federal law limits your liability for unauthorized credit card transactions. Report a lost or stolen card promptly, and you won’t be held responsible for fraudulent charges.

Debit Card Reporting Procedures

- Timely Reporting is Key: With debit cards, your liability for unauthorized transactions depends on how quickly you report the loss. Report it promptly, and your liability is limited. Delay, and you might be responsible for more charges.

Looking Beyond the Plastic

Credit Score Monitoring

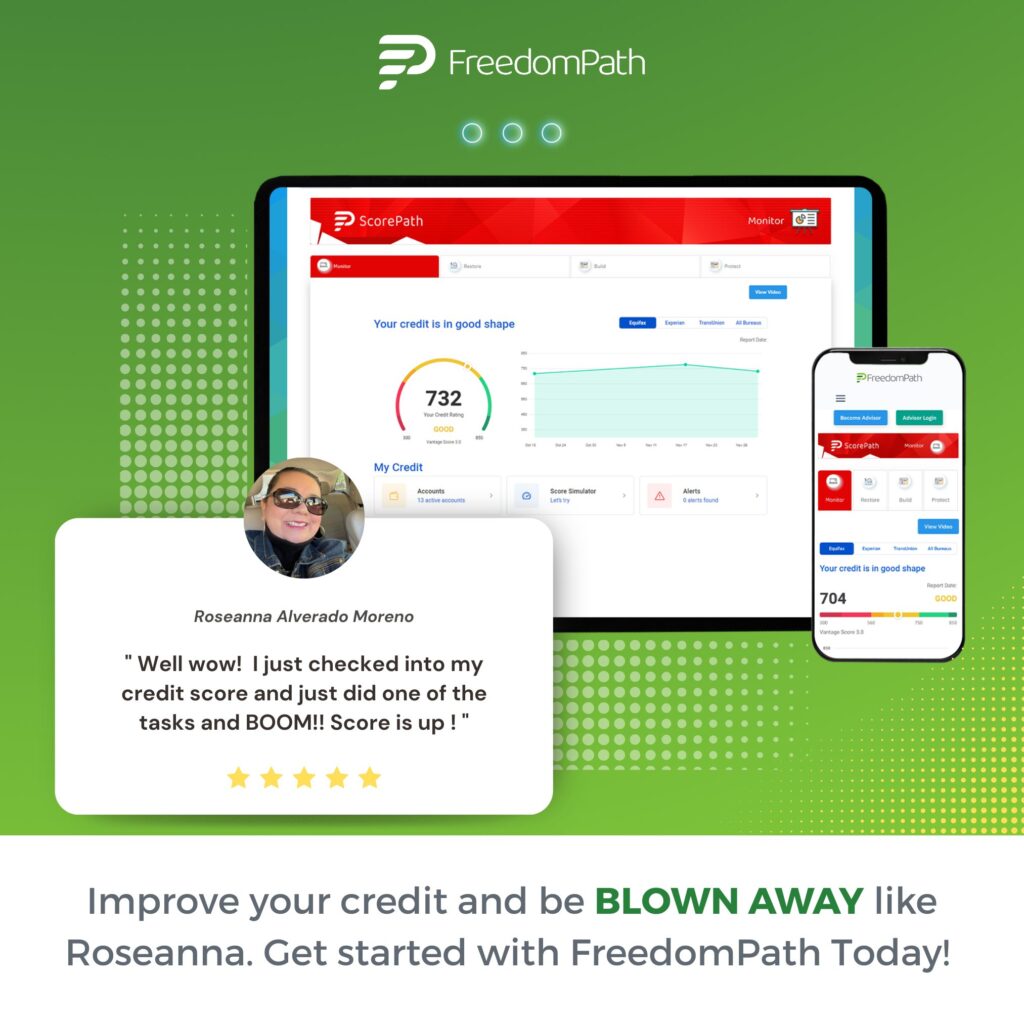

- Continuous Monitoring: Your credit score is a dynamic number that changes based on your financial behavior. Consider using credit monitoring services to closely monitor any fluctuations and promptly address issues.

Financial Apps for Deeper Insights

- Budgeting and Financial Wellness Apps: Whether you’re using credit cards or debit cards, there’s an app for that. Explore budgeting apps that analyze your spending patterns, provide financial insights, and help you make informed decisions.

Preparing for Financial Milestones

Credit Cards and Major Purchases

- Credit Score Preparation: If you’re gearing up for a major purchase like a home or car, ensure your credit score is in top shape. Plan ahead, pay down debts, and make timely payments to present the best possible financial picture to lenders.

Debit Cards and Saving Strategies

- Automated Savings for Goals: Use your debit card as a tool for achieving financial goals. Set up automatic transfers to a dedicated savings account for specific purposes, whether a vacation or emergency fund.

Empowering the Next Generation

Teaching Financial Literacy

- Credit Card Education: When introducing financial concepts to the next generation, emphasize responsible credit card use. Teach the importance of paying bills on time, understanding interest rates, and using credit as a tool for financial growth.

Debit Card for Financial Responsibility

- Building Budgeting Habits: Start with a debit card to instill budgeting habits. It’s a hands-on way for young individuals to understand the connection between spending and available funds.

Final Words of Wisdom

As we conclude this comprehensive guide to credit and debit cards, remember that financial literacy is a lifelong journey. Stay informed, adapt to the evolving financial landscape, and embrace the power of making educated financial decisions.

A Financially Empowered Future

So, credit or debit cards – which is the superhero in your wallet and why?

The truth is it depends on your lifestyle, spending habits, and financial goals.

For the ultimate financial success, consider having both in your arsenal.

Use your credit card strategically for rewards and emergencies while relying on your debit card for everyday transactions and budgeting.

The power is in your hands, whether you’re swiping your way to cashback heaven with your credit card or practicing the art of budgeting with your debit card.

By understanding the nuances of each card and implementing smart strategies, you can confidently navigate the plastic landscape.

In this plastic duel, the winner is you – the master of your financial destiny. Armed with the knowledge of when to swipe and when to insert, you’re ready to conquer the financial realm.

What’s your go-to plastic companion, and why?

Your Assignment

Are you ready to take your financial journey to the next level?

Share your favorite credit card hacks or debit card budgeting tips in the comments below.

Let’s build a community of financially savvy individuals supporting each other on the path to financial greatness. Swipe, tap, and conquer, my friends! 💳✨

Yup, you guessed it. Sometimes I throw in those magical affiliate links that can whisk you away to credit utopia. But wait, there’s more! Each time you click on one of these bad boys and decide to snag a deal, a tiny trumpet-playing squirrel delivers a small bag of gold coins to our castle. In other words, I might earn a little something-something. Just know that I would never use a link that I don’t personally use myself and/or highly recommend.

About the Author

Meet Ashley Effinger, the Credit Queen and FreedomPath Advisor! Digital marketing royalty, I’m all about conversions and changing lives! By day, I improve credit scores, learn budgeting tricks, and build lasting wealth with my guidance. By night, I’m a rockstar wife and a supermom of 5 amazing kiddos! When not slaying credit myths, I indulge in my passions: reading, jet-setting, and sipping smoothies! Follow me for credit tips and a dose of laughter!

Drop me a line (say hi, ask a credit repair question, fan out, etc.): badcreditisexpensive@gmail.com

Ready to get started fixing YOUR credit? ashley@mycreditqueen.com

Let’s Connect on  Social

Social

LinkedIn: Ashley Effinger

Pinterest: @badcreditisexpensive

Instagram: @badcreditisexpensive

Youtube: @BadCreditIsExpensive

Twitter: @creditqveen

Facebook: @badcreditisexpensive

TikTok: @badcreditisexpensive

Medium: Ashley Effinger | Subscribe