Ahoy, aspiring homeowners! So, you’ve set your eyes on the majestic castle of homeownership, and you’re ready to storm its gates with your trusty sword (read: mortgage application).

But wait, what’s that menacing dragon guarding the entrance?

Why, it’s the dreaded credit score! Fear not, for I, your trusty credit expert, am here to guide you through the tricky waters of credit scores and help you slay that dragon, even if your credit history resembles a misadventure-filled journey through Middle Earth.

Let’s embark on this epic quest to unearth the credit score needed to buy a house in the mystical year of 2023.

The Magic Number – What Credit Score Do You Need?

Picture this: You’re standing at the crossroads of credit and homeownership, armed with curiosity and a burning desire to possess your own abode. The question is, what credit score is the golden ticket to unlock the doors of that dream house?

Well, in the enchanted year of 2023, the ideal credit score dances around the mystical number of 620 to 740. This range opens doors to favorable interest rates, flexible loan terms, and a smoother mortgage application process.

A score below 620 might feel like you’re wearing a leaden armor, slowing your progress, but fret not! There are still ways to venture forth.

The Credit Score Chronicles – Understanding the Landscape

Before you dive into the fray, it’s essential to understand how the credit score universe works. Your credit score is like a character sheet in a role-playing game, summing up your financial history. It’s shaped by five key elements:

- Payment History (35%): Think of this as your quest log. Timely payments on credit cards, loans, and bills earn you XP (experience points) in the form of a good credit score. Late payments, on the other hand, cast a shadow over your reputation.

- Credit Utilization (30%): Imagine your credit limit as a magic barrier. If you constantly flirt with breaching this barrier, your credit score takes a hit. Aim to use no more than 30% of your available credit to boost your score.

- Length of Credit History (15%): This is like your character’s backstory. The longer you’ve been building credit, the richer your history becomes, boosting your credit score. A seasoned warrior has better odds in the battle for a mortgage.

- Credit Mix (10%): Diversity is key! A varied mix of credit accounts (like credit cards, student loans, and car loans) showcases your adaptability in different financial situations.

- New Credit (10%): This reflects your recent quests for credit. Opening too many new accounts in a short span sends up a red flag to lenders, as it might hint at financial instability.

Mastering Magic – How to Improve Your Credit Score

If your credit score is more dismal than a rainy day in a haunted forest, fear not! You can still channel your inner wizard and find ways to mend your credit score.

- Battle the Balances: Attack those high credit card balances like a fearless warrior. Tame them down and watch your credit score ascend.

- The Ancient Rite of Payment: Make timely payments a sacred ritual. Automate them if needed, ensuring you’re never late for a virtual meeting with your credit score.

- Credit Utilization Elixir: Bring down your credit utilization to below 30%. This elixir has a potent effect on raising your credit score.

- Age Before Beauty: Embrace the wisdom of your credit history. Keep old accounts open, even if they’re not your favorites. Their age adds gravitas to your score.

- Strategic Inquiries: Limit new credit inquiries to those you absolutely need. Too many inquiries can drain the vitality from your credit score.

The Quest for a Mortgage with Bad Credit

Ah, now for the daring part! You’ve been training your credit score like a determined knight, but it’s still on the lower side. Fear not, intrepid adventurer, for there are paths to homeownership, even for those with not-so-shiny credit armor.

- FHA Loans: These are like magical blessings for those with low credit scores. With a down payment as low as 3.5%, these loans offer a glimmer of hope.

- VA Loans: If you’re a veteran, you’re in luck! VA loans require no down payment and often have more forgiving credit score requirements.

- USDA Loans: If you’re drawn to the rural life, USDA loans might be your savior. They offer 100% financing to those who meet their location and income criteria.

- Down Payment Enchantment: If you can muster a higher down payment, lenders might be more inclined to overlook your credit score’s rough edges.

- Co-Signer Charm: If you have a trusted friend or family member with a sparkling credit history, their co-signing might pave your path.

Decoding Credit Score Requirements for Different Mortgage Loans: Your Path to Homeownership

You’ve polished your armor and sharpened your sword, ready to embark on the quest of homeownership. But every knight needs a map; in this case, it’s the knowledge of the specific credit score requirements for different types of mortgage loans.

Fear not, valiant adventurer, for I shall illuminate your path with the credit score thresholds for FHA, VA, and USDA loans.

FHA Loans: The Bridge to Affordable Homeownership

FHA (Federal Housing Administration) loans are the gleaming bridge for those aspiring homeowners whose credit score may not be soaring high yet. They offer a lower barrier to entry, catering to borrowers with credit scores that might not be as knightly as they’d wish.

Credit Score Needed for FHA Loans: The majestic minimum credit score for FHA loans dances around 500 to 580. However, remember, in the land of credit scores, the higher you aim, the more advantageous the terms of your loan shall be.

- 500-579: If your credit score lies within this range, you’re still in the game, but you’ll need to muster a down payment of at least 10% of the home’s price.

- 580 and above: Ah, the sun shines a bit brighter for you! With a credit score of 580 or higher, you can trot onto the FHA loan path with a down payment as low as 3.5%.

VA Loans: Honoring Our Veterans with Affordable Home Loans

VA (Veterans Affairs) loans are the noble steed that veterans, active-duty service members, and certain members of the National Guard or Reserves can ride into the realm of homeownership.

These loans come with a distinct advantage: no requirement for a down payment.

Credit Score Needed for VA Loans: The realm of VA loans is known for its benevolence toward credit scores. While there is no official minimum credit score requirement, lenders typically prefer a credit score of 620 or higher.

However, it’s worth noting that the VA doesn’t directly issue loans but rather guarantees a portion of the loan, making it more accessible for eligible veterans to secure a mortgage from a private lender.

USDA Loans: Exploring Rural Routes to Homeownership

USDA (United States Department of Agriculture) loans are a secret garden of opportunity, especially for those who yearn for the rural life. These loans cater to low- to moderate-income borrowers who wish to settle in eligible rural and suburban areas.

Credit Score Needed for USDA Loans: The USDA has a gentler approach to credit scores, but there’s a catch as with all things financial. The typical credit score range for USDA loans is 640 and above. However, some lenders might consider lower credit scores under certain circumstances, factoring in other aspects of your financial profile.

Remember, my brave compatriots, these credit score thresholds are not carved in stone tablets but guidelines set by the lenders and institutions offering these loans. While a certain credit score might open the door to these loans, remember that other aspects of your financial history, like debt-to-income ratio and employment stability, also contribute to the lender’s decision.

In your pursuit of homeownership, remember that credit scores, while important, are but one piece of the puzzle. Building strong financial habits and being aware of your financial landscape can set you on a course to triumph over the challenges and seize the castle of your dreams.

The Grand Finale – Closing Thoughts and Victory Dance

As you stand at the precipice, ready to sign those mortgage papers, remember that your credit score is not the only worthy attribute in your arsenal. Your determination, perseverance, and willingness to learn make you a formidable contender in the great homeownership quest.

So, whether your credit score is as dazzling as Excalibur or as rough as a rogue’s dagger, remember that the castle of homeownership is within reach. Arm yourself with knowledge, wield the sword of responsible financial habits, and ride into the sunset of homeownership like the epic hero you are. The credit score dragon may be fierce, but with the right strategy, you shall emerge victorious!

In this epic saga of credit scores and homeownership, we’ve uncovered the enchanted numbers, delved into the arcane art of improving credit scores, and explored paths to homeownership even in the face of challenging credit histories.

So go forth, intrepid warrior, and may the credit gods smile upon your quest for a home sweet home!

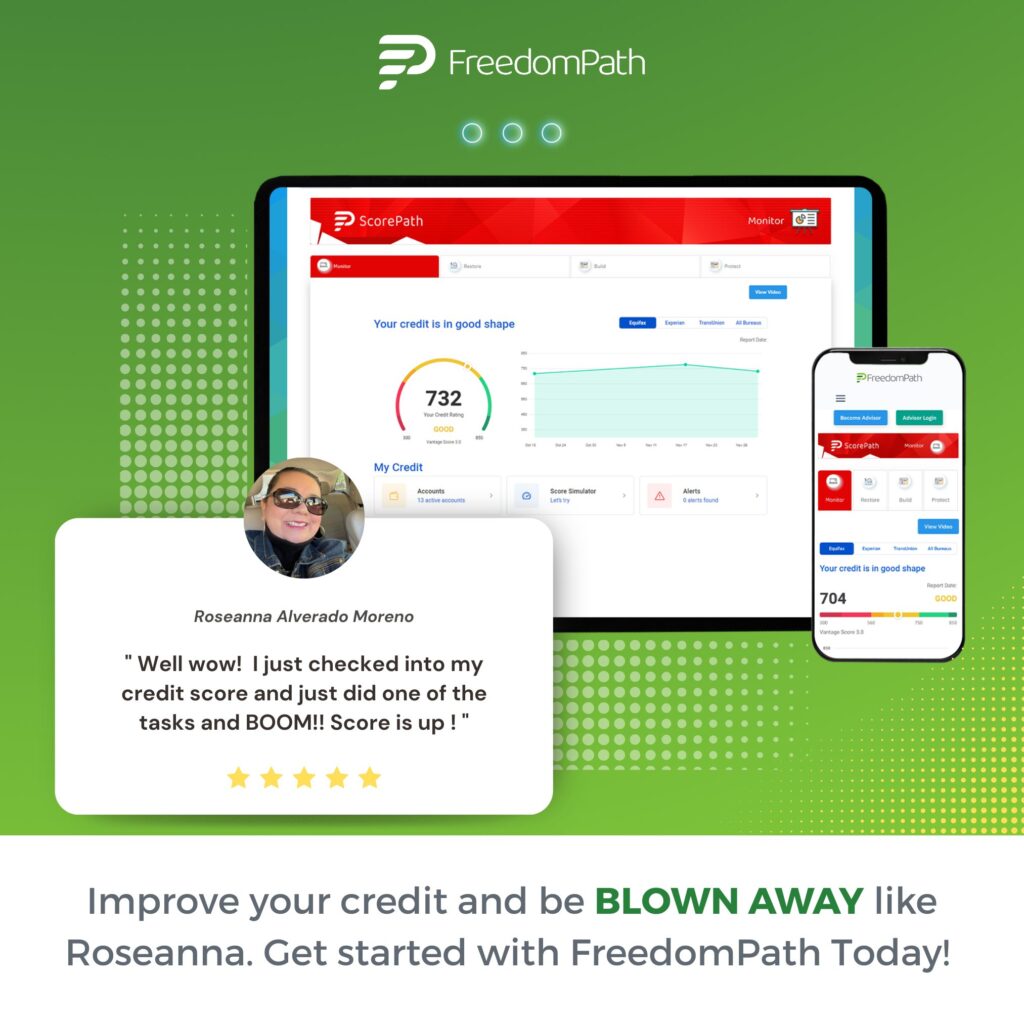

Want to buy your dream home with good credit? FreedomPath helps you keep your financial affairs in order, dispute credit errors, add monthly payments to reporting (e.g. cell phone, rent, subscriptions, and utility bills), monitor your credit from all three bureaus, several budget calculators, and so much more!

Yup, you guessed it. Sometimes I throw in those magical affiliate links that can whisk you away to credit utopia. But wait, there’s more! Each time you click on one of these bad boys and decide to snag a deal, a tiny trumpet-playing squirrel delivers a small bag of gold coins to our castle. In other words, I might earn a little something-something. Just know that I would never use a link that I don’t person

Great content! Super high-quality! Keep it up!

You’ve been great to me. Thank you!

You helped me a lot with this post. I love the subject and I hope you continue to write excellent articles like this.