Hello there, dear readers! Welcome to a thrilling exploration of the mysterious world of credit scores. Today, we’re diving deep into the magical realm of 700, which, as you might have guessed, is often touted as the mystical “good” credit score. But is it a financial wizard’s wand or another mediocre spell in the grand book of credit?

Imagine you’re in the midst of a fierce debate between your financially savvy friend and your cautious cousin about whether a 700 credit score is good or bad.

Your friend insists it’s the golden ticket to financial freedom, while your cousin argues it’s just a halfway mark.

Who should you believe?

Let’s get our magnifying glass out and examine this enigma from all angles!

The 700 Credit Score Unveiled: Good or Bad?

So, you’ve crossed that elusive 700 milestone on your credit score. Congratulations are in order! But hold your unicorns because the financial fairy tale isn’t over just yet. A 700 credit score drops down in the “good” range, but it’s not the top-tier “excellent” score that lenders often swoon over.

To be precise, credit scores typically range from 300 to 850. Anything above 700 is indeed a good score, while a score above 750 is generally considered excellent.

But what makes a 700 score so intriguing?

The Benefits of a 700 Credit Score

Let’s start with the perks, shall we?

Having a 700 credit score unlocks doors to several financial wonders:

- Access to Better Interest Rates: Lenders look at your credit score when deciding loan interest rates. With a 700 score, you’re likelier to snag reduced interest rates on car loans, credit cards, personal loansand mortgages. This can really save you a ton of cash in the long run.

- Easier Loan Approvals: Lenders consider your credit score when approving or denying loan applications. A 700 credit score signals that you’re a responsible borrower, making securing loans for your dream home or that shiny new car more accessible.

- Higher Credit Limits: Credit card companies are more willing to extend higher credit limits to individuals with a 700 credit score. This can be a game-changer if you’re aiming to increase your purchasing power or manage unexpected expenses.

- Better Rental Terms: Landlords often scrutinize credit scores when choosing tenants. With a 700 score, you’re more likely to secure that swanky apartment or house you’ve been eyeing.

But, dear reader, there’s always a flip side to the coin, and the same goes for credit scores.

The Drawbacks of a 700 Credit Score

Before you start planning your financial empire with your 700 credit score, let’s uncover the not-so-magical aspects:

- Not Top-Tier: While 700 is good, it could be better. Lenders may still scrutinize your credit history, and you might not qualify for the absolute best interest rates or credit card perks.

- Potential for Improvement: If you’re content with a 700 credit score, you might miss the opportunity to climb higher. An excellent credit score opens doors to even better financial opportunities.

- Vulnerable to Economic Shifts: Credit scores can fluctuate due to various factors, including economic downturns. A 700 score might drop if you encounter unexpected financial challenges.

- Still Subject to Rejections: Lenders consider multiple factors when approving loans, and a 700 score doesn’t guarantee automatic approval. Your income, debt-to-income ratio, and other factors also play a role.

Here’s the million-dollar question:

Should individuals with a 700 credit score strive for a higher credit score?

To Climb or Not to Climb: The Quest for a Higher Credit Score

Picture this: You’ve just reached the summit of a 700 credit score mountain. Should you plant your flag and declare victory or set your sights on loftier peaks?

Here’s the scoop: Striving for a higher credit score can be smart, but it’s not a one-size-fits-all answer. It heavily depends on your financial goals and circumstances. Let’s break it down:

- Yes, Go for the Gold (800+): If you’re planning significant financial moves, such as buying a home or starting a business, pushing your score into the excellent range (above 750) can unlock even more favorable terms and opportunities. It’s like leveling up in a video game – the rewards get better.

- No, Stay Content: If you’re not planning any significant financial endeavors in the near future and are comfortably managing your current financial responsibilities, maintaining a 700 credit score can be perfectly fine. After all, you’re already in the “good” zone.

- Always Practice Healthy Credit Habits: Whether aiming higher or staying put, remember to maintain healthy credit habits. It’s vital to always make on time payments, keep your credit utilization low (under 30%), and monitor your credit report for errors.

The Magic Behind the Numbers: What Makes a 700 Credit Score?

Before we delve further into the enchanting world of credit scores, let’s take a moment to understand what goes into making a 700. Credit scores are like a well-guarded secret recipe, with a dash of payment history, a sprinkle of credit utilization, and a pinch of credit mix. Let’s break down the ingredients:

- Payment History (35%): This is the bread and butter of your credit score. It’s all about whether you pay your bills on time. Consistent, on-time payments are the golden ticket here. Missed payments can turn your credit score into a pumpkin.

- Credit Utilization (30%): This of this as the magic potion of credit scores. It’s the percentage of your available credit that you’re using. Keeping it low, ideally below 30%, tells the credit wizards that you’re responsible and not maxing out your credit cards.

- Credit History Length (15%): The age of your credit accounts matters. A more extended history can boost your score. That’s why keeping those old credit cards open is often wise, even if you use them sparingly.

- Credit Mix (10%): Diversity is the spice of life and credit scores. A solid mix of credit types, like credit cards, installment loans, and mortgages, can work in your favor. But remember, don’t go opening new accounts just for variety’s sake.

- New Credit (10%): Opening too many new credit accounts in a short period can raise eyebrows among the credit deities. It may suggest you’re in financial distress or about to embark on a spending spree. Be cautious with new credit inquiries.

The Quest for Credit Score Excellence

Now, let’s talk about the higher peaks of credit score excellence. While 700 is indeed good, what if you’re gunning for a credit score that’s so impressive it sparkles?

Here are some strategies for those looking to ascend the credit score summit:

- Review Your Credit Report: Before starting your journey, review your credit report for errors. Dispute any inaccuracies, as they can drag your score down.

- Pay On Time, Every Time: The most critical factor of your credit score is your payment history. Be sure to set up automatic payments or reminders to ensure you never miss a due date.

- Reduce Credit Card Balances: High credit card balances relative to your credit limits can harm your score. Focus on paying down those balances below 30% of your credit limit.

- Avoid Closing Old Accounts: As mentioned earlier, the age of your credit history matters. Keep your oldest accounts open to maintain a long credit history.

- Limit New Credit Applications: Only apply for new credit when necessary. Multiple inquiries can have a negative impact on your score.

- Diversify Your Credit Mix Carefully: If you’re considering adding a new credit account to diversify your mix, do so judiciously and in line with your financial goals.

- Monitor Your Credit: Keep a vigilant eye on your credit score and report. Many websites and apps offer free credit monitoring services.

- Be Patient: Building and improving credit takes time. Be patient and persistent in your efforts. Rome wasn’t built in a day, and neither is a stellar credit score.

The Bottom Line: A 700 Credit Score Is Your Ticket to Financial Opportunity

So, is a 700 credit score good or bad?

The answer is that it’s pretty darn good, but it’s not the ultimate treasure chest of financial wonders.

Whether you aim higher or bask in the glory of your 700, the key is maintaining healthy credit habits and making decisions that align with your financial goals.

Pay your bills on time, keep your credit utilization low, and make informed financial decisions. Remember, credit scores are just one piece of the financial puzzle. Building wealth, saving for the future, and achieving your dreams requires a holistic approach to money management.

In the grand scheme of things, a 700 credit score is your golden ticket to financial opportunity. It’s not just a number; it’s a reflection of your financial responsibility and a key that can unlock doors to better loans, lower interest rates, and favorable financial terms.

As you venture into the world of credit scores, remember that your credit score is a dynamic creature. It can change over time based on your financial behavior. With diligence and discipline, you can steer it in the direction of excellence.

So, go ahead and conquer your credit score journey. Unleash the financial wizard within you and watch as your credit score transforms into the magical key that opens doors to your dreams.

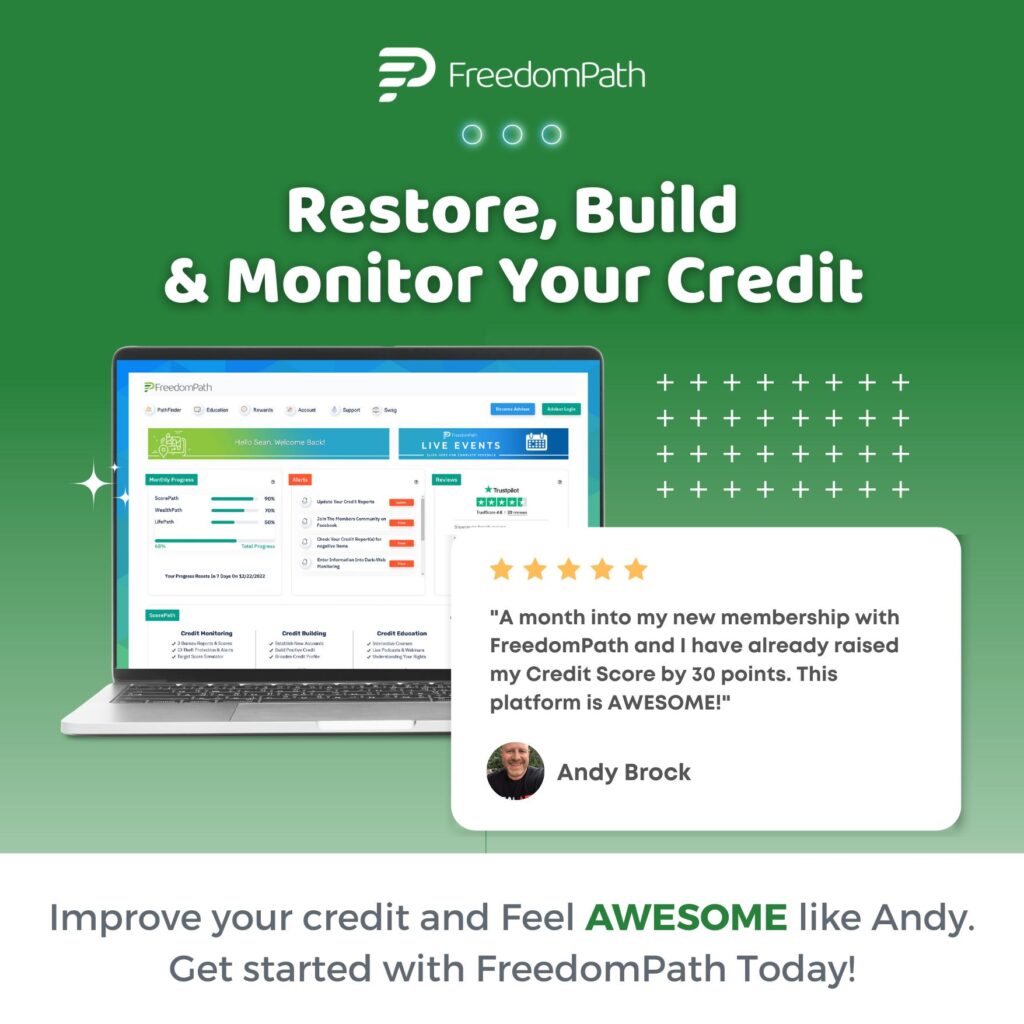

Are you ready to embark on your credit score journey and uncover the financial wonders that await you? Don’t delay; your financial destiny is in your hands. Click the link below to check your credit score and begin your enchanting adventure today!

Click here to check your credit score and set forth your path to financial excellence!

Yup, you guessed it. Sometimes I throw in those magical affiliate links that can whisk you away to credit utopia. But wait, there’s more! Each time you click on one of these bad boys and decide to snag a deal, a tiny trumpet-playing squirrel delivers a small bag of gold coins to our castle. In other words, I might earn a little something-something. Just know that I would never use a link that I don’t personally use myself and/or highly recommend.

About the Author

Meet Ashley Effinger, the Credit Queen and FreedomPath Advisor! Digital marketing royalty, I’m all about conversions and changing lives! By day, I improve credit scores, learn budgeting tricks, and build lasting wealth with my guidance. By night, I’m a rockstar wife and a supermom of 5 amazing kiddos! When not slaying credit myths, I indulge in my passions: reading, jet-setting, and sipping smoothies! Follow me for credit tips and a dose of laughter!