Hey fellow credit conquerors!

Welcome to the realm of financial sovereignty, where knowledge truly is power, and wielding it can transform you into the Credit Queen or King you were born to be. Today, we dive deep into the royal decree known as the Fair Credit Reporting Act (FCRA), a majestic piece of legislation that bestows upon you, the consumer, a plethora of rights and powers when it comes to disputing errors on your credit report.

So, don your crown and scepter, for we’re about to embark on a journey that will empower, educate, and perhaps even tickle your financial funny bone.

The Crown Jewels: Understanding the Fair Credit Reporting Act (FCRA)

Picture this: You’re strutting through the financial forest, your credit score held high like a banner of honor. But, uh-oh, there’s a thorn on your credit report—a nasty error that’s tarnishing your otherwise sparkling record. Fear not, for the Fair Credit Reporting Act is your knight in shining armor.

1. The Grand Introduction: What is the FCRA?

The FCRA, enacted in 1970, is your guidebook to credit reporting fairness and accuracy. It’s like a treasure map, showing you how to navigate the intricate maze of credit reporting bureaus, lenders, and information furnishers.

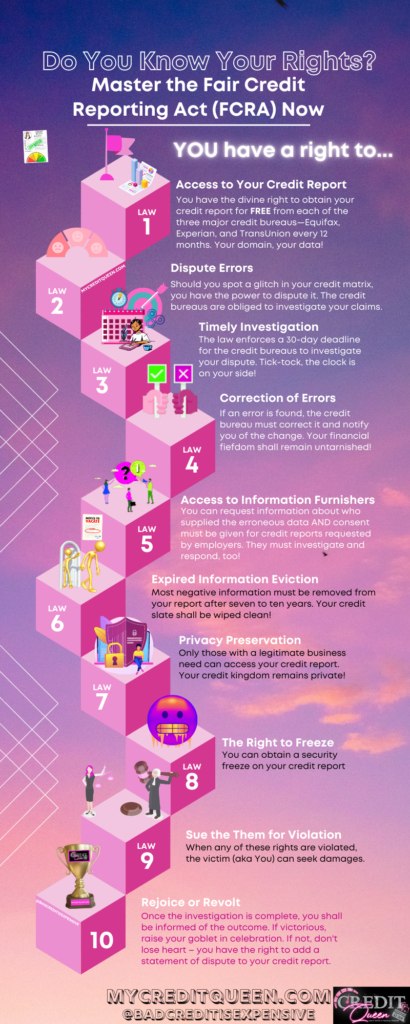

2. The Regal Rights Granted by FCRA

Behold, for the FCRA bestows upon you a set of rights that will make even the most extravagant of monarchs jealous:

- 👑 Access to Your Credit Report: You have the divine right to obtain your credit report for free from each of the three major credit bureaus—Equifax, Experian, and TransUnion—every 12 months. Your domain, your data!

- 👑 The Right to Dispute: Should you spot a glitch in your credit matrix, you have the power to dispute it. The credit bureaus are obliged to investigate your claims.

- 👑 Timely Investigation: The law enforces a 30-day deadline for the credit bureaus to investigate your dispute. Tick-tock, the clock is on your side!

- 👑 Correction of Errors: If an error is found, the credit bureau must correct it and notify you of the change. Your financial fiefdom shall remain untarnished!

- 👑 Access to Information Furnishers: You can request information about who supplied the erroneous data AND consent must be given for credit reports requested by employers. They must investigate and respond, too!

- 👑 Expired Information Eviction: Most negative information must be removed from your report after seven to ten years. Your credit slate shall be wiped clean!

- 👑 Privacy Preservation: Only those with a legitimate business need can access your credit report. Your credit kingdom remains private!

- 👑 The Right to Freeze: You can obtain a security freeze on your credit report

- 👑 Sue the Them for Violation: When any of these rights are violated, the victim (aka You) can seek damages.

3. The Quest for Accurate Reports

Brace yourselves, dear courtiers, for the credit report might not always be accurate. Statistically, errors are more common than dragon sightings. Unbeknownst to you, a simple typo might cast a shadow on your report. But fear not, the FCRA empowers you to tackle these inaccuracies head-on:

- 🌟 Summon Your Evidence: Gather the financial scrolls that prove your case. Bank statements, receipts, or a unicorn’s sworn affidavit – anything goes!

- 🌟 The Regal Dispute Letter: Draft a majestic letter, summoning the credit bureau’s attention to the error. Be firm, but let your inner Credit Queen’s grace shine through.

- 🌟 Patience, My Liege: The credit bureau now has 30 days to investigate. Spend this time practicing your royal wave.

- 🌟 Rejoice or Revolt: Once the investigation is complete, you shall be informed of the outcome. If victorious, raise your goblet in celebration. If not, don’t lose heart – you have the right to add a statement of dispute to your credit report.

4. Slaying the Credit Dragon: Exposing Frequent Violations of the FCRA

In the enchanted world of credit reporting, where credit bureaus, debt collectors, and creditors dance in a complicated waltz, violations of the FCRA can rear their ugly heads. But fear not, my loyal subjects, for these transgressions do not go unpunished.

Let’s arm ourselves with knowledge about these frequent violations:

Reporting Outdated Information: The Ghosts of Credit Past

In the kingdom of credit reporting, time is both a healer and a revealer. The FCRA decrees that outdated information, like a phoenix, should rise from the ashes and be expunged from your records after its rightful time. If a lender or collector insists on showcasing the skeletons of your financial past, they’re violating the FCRA.

False Reporting: The Deceivers of Credit

Imagine a jester spreading rumors that you’re friends with a dragon. False information on your credit report can be just as damaging and absurd. According to the FCRA, your report should be a mirror reflecting the truth. If it’s showing a fairytale instead, the credit realm is in violation.

The Accidental Mix-Up: The Case of Mistaken Identity

Oh, the tangled webs we weave when files of different fates intertwine! The FCRA mandates that your credit profile should remain your own, free from the chaotic crossbreeding of credit stories. If someone else’s tale becomes part of your tapestry, it’s an intrusion the FCRA won’t tolerate.

Silence of the Creditors: The Debt Dispute Disappearance

In the grand theater of credit, a debt dispute is a duel for truth. The FCRA requires that creditors be informed of this clash, lest they become ignorant spectators. Should they fail to join the fray, they’re in breach of the law.

False Information’s Persistence: The Unyielding Taint

When falsehoods stain your credit canvas, the FCRA mandates their prompt removal upon discovery. Failure to expunge these smears from your reputation is a violation that shall not go unnoticed.

The Silence Spreads: Neglecting the Credit Reporting Network

Imagine a storyteller withholding a plot twist from certain characters. The FCRA demands that when you dispute a debt, all credit reporting agencies must be in the know. If the information is hushed up, the law’s command has been flouted.

Privacy Pillaging: The Forbidden Gaze

In the realm of credit, privacy is your right, and the FCRA is your shield. Unauthorized intrusions into your financial kingdom by unwanted observers violate this sacred principle.

Concealing the Darkness: The Hush About Negative Credit

Dark clouds of negative credit information should not gather without your knowledge. The FCRA requires a timely warning of impending storms on your credit horizon. Failure to heed this call is a violation that carries consequences.

Decisions in Shadows: The Unseen Consequences

If a credit decision is made against you, it’s your right to know and understand why. The FCRA’s light banishes the shadows from these decisions. Failure to illuminate them is a transgression that demands remedy.

Hidden Treasure: The Right to a Free Credit Report

Ah, the FCRA’s benevolence shines once more! You possess the right to a free credit report, a map to your financial lands. If this treasure is withheld, it’s a violation that cannot go unchallenged.

The Verdict of Dispute: Results in the Shadows

When you challenge the credit cosmos, you deserve to know the outcome. The FCRA requires that the results of an investigation into a debt dispute be shared with you. If this revelation is denied, justice beckons.

5. The Royal Proclamation

Ladies and gentlemen, let us heed the call to action and embrace our credit rights with vigor! Armed with the knowledge of the FCRA, we can don our capes of confidence and venture into the world of credit reporting with heads held high. Remember, your financial journey is a tale of triumph waiting to be written, and the FCRA is your quill of justice.

So, dear credit warriors, may your credit score soar like a phoenix, your disputes be resolved swiftly, and your financial realm be one of abundance and prosperity. Embrace your role as the Credit Queen or King, and let the FCRA be your scepter of power.

Now, go forth and claim your credit throne, for the world of finance is yours to conquer!

Yours royally,

The Credit Queen

P.S. If you seek further guidance on navigating the labyrinthine paths of credit reporting, remember that knowledge is the key to your crown. Consult me via email ashley@mycreditqueen.com and/ or explore the wonders of online resources, and continue your journey to financial sovereignty. Onward, my fellow monarchs!