Hey there, financial explorers! Welcome to a guide that dives deep into the murky waters of financial infidelity – a topic that might not be as glamorous as sipping cocktails on a yacht, but is just as important (if not more) for the health of your relationship. We’re going to uncover the secrets, signs, and solutions to ensure that your financial journey together remains smooth sailing.

What Is Financial Infidelity? Common Signs & Examples

Picture this: You and your partner are savoring a romantic candlelit dinner. As you indulge in a delectable dessert, your partner drops a bombshell – they’ve been secretly withdrawing substantial amounts of money from your joint account without so much as a whisper of explanation.

You might think, “Wait, are we talking about a thriller movie plot or real-life relationships?”

Welcome to the world of financial infidelity – a tangled web of lies and secrets that could make even the juiciest soap opera blush.

What Is Financial Infidelity?

- Financial infidelity is the sneaky practice of concealing financial actions, decisions, or information from your partner that could impact the overall financial health of your relationship.

It’s like ordering that second dessert when you’ve both agreed to stick to a budget – except much worse, because it involves money, trust, and the foundation of your partnership.

Some specific examples of financial infidelity include:

- Large Withdrawals from Joint Accounts: Your partner suddenly empties a significant chunk from your joint account, leaving you wondering if they’re stockpiling cash under the mattress.

- Siphoning Money for Personal Debts: Money from your shared account mysteriously vanishes to pay off debts you never knew existed.

- Unequal Contributions to Joint Accounts: One partner isn’t holding up their end of the financial bargain, leaving you feeling like you’re shouldering the load.

- Sneaky Spending: You find out your partner’s been splurging on a guilty pleasure without consulting you.

- Hidden Debts: Turns out, your partner has a financial skeleton in the closet – an undisclosed debt they’ve been keeping hush-hush.

- Unannounced Spending Sprees: Your partner returns home with a shiny new toy, but it wasn’t part of the plan.

- Stealthy Financial Decisions: Your partner invests in that risky business venture they know you’d veto if you had a say.

- Budget Bypassing: Money mysteriously evaporates from your joint account, exceeding the budget you both agreed on.

- Shopaholic Secrets: Your partner’s shopping addiction has reached new heights, and they’re now keeping their splurges on the down-low.

How Does Financial Infidelity Impact a Relationship?

Think of your relationship as a garden you both lovingly tend to. Financial infidelity is like a pesky weed – it might start small, but if left unchecked, it can choke the life out of your partnership. It erodes trust, breeds resentment, and can lead to heated arguments that can make World War III seem like a tea party.

Imagine planning for a future together – a dream home, vacations, and maybe even starting a family. Now, sprinkle some financial secrecy into the mix. Suddenly, that dream home starts looking like a distant mirage, and those vacations turn into tense battles over budgeting.

Reasons for Financial Infidelity

Financial infidelity doesn’t just sprout out of nowhere. It often has roots in deeper issues within the relationship. It might be a result of:

- Mismatched Financial Values: If you’re a penny-pincher and your partner’s a lavish spender, conflict is almost guaranteed.

- Power Struggles: Money can symbolize power within a relationship. Financial secrets might arise from a struggle to maintain control.

- Fear of Judgment: If one partner fears being criticized for their financial decisions, they might resort to hiding them.

- Lack of Communication: When financial discussions are as rare as a unicorn sighting, misunderstandings and secrecy take root.

- Insecurity: Someone might feel inadequate about their financial contribution, leading them to hide their actions.

- Addictions: Whether it’s shopping, gambling, or even substance abuse, addictions can lead to financial secrecy.

15 Financial Infidelity Red Flags

Detecting financial infidelity isn’t about becoming a Sherlock Holmes of money. It’s about being aware of the signs that could signal trouble.

Here are 15 red flags:

- Private About Finances: Partners who avoid discussing money matters like the plague.

- Defensive About Finances: Innocent questions about money result in defensive, snappy responses.

- Undisclosed Credit Card Statements: Mysterious new credit card statements that never make it into conversation.

- Projection of Accusations: They start accusing you of financial secrecy, maybe to divert attention from their own actions.

- Stonewalling: Conversations about money suddenly hit a brick wall.

- Change of Account Status: Their name’s conspicuously absent from joint credit card accounts.

- Past History of Hidden Information: This isn’t their first rodeo when it comes to hiding financial info.

- Secrecy About Funding Big Purchases: That shiny new gadget they’ve got? No word on where the money came from.

- Partner Left Out of Financial Decisions: They’re making big decisions solo, ignoring your input.

- Secret Bank Account: You stumble upon a secret stash they’ve been cultivating.

- Changed Online Banking Passwords: Suddenly, you’re locked out of their financial world.

- Cryptic About Income: Their paycheck might as well be classified information.

- Selective Spending: They’re Santa Claus to everyone except you.

- Hiding Financial Records: Bills and receipts suddenly vanish from sight.

- Refusal to Budget: The mere mention of budgeting sends them running for the hills.

How to Avoid Financial Infidelity

Preventing financial infidelity isn’t about adopting a bunker mentality. It’s about creating a financial atmosphere of transparency and trust. Here’s how:

- Regular Money Talks: Make financial discussions a routine. Share your financial goals, concerns, and plans openly.

- Set Clear Expectations: Define who contributes what to your shared finances. Discuss how you’ll manage joint and individual expenses.

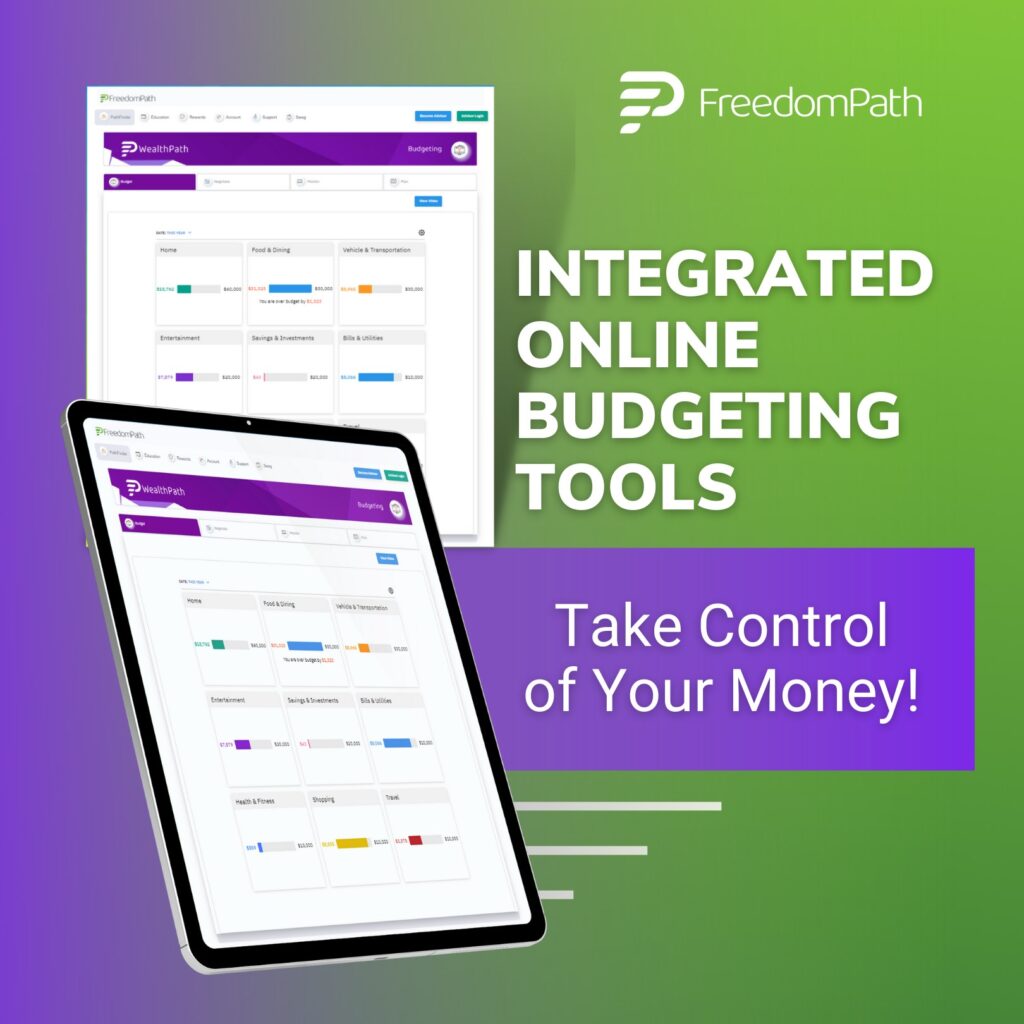

- Create a Budget Together: Craft a budget that aligns with both your goals. This ensures a mutual understanding of where money goes.

- Open Joint Accounts: A joint account promotes financial transparency, making it easier to track expenses and contributions.

- Be Supportive, Not Judgmental: If one partner slips up financially, provide support and solutions rather than criticism.

- Discuss Splurges: Before making major purchases, chat with your partner. Transparency is key.

- Plan for Financial Emergencies: Create an emergency fund together to handle unexpected financial challenges.

- Consider Financial Counseling: Seeking professional help can untangle complex financial issues.

How to Overcome Financial Infidelity in Your Relationship

So, you’ve stumbled upon evidence of financial infidelity. Don’t start writing obituaries for your relationship just yet. Here’s how to confront the issue head-on:

- Choose the Right Time and Place: Don’t corner your partner during a heated argument. Pick a calm, private setting.

- Be Honest and Direct: Express your feelings openly. Use “I” statements to avoid sounding accusatory.

- Listen Actively: Allow your partner to share their perspective without interrupting. Effective communication goes both ways.

- Acknowledge Feelings: Both of you might feel hurt, angry, or betrayed. Validating these emotions helps in the healing process.

- Seek Professional Help: A financial counselor or therapist can facilitate productive conversations.

- Rebuild Trust: Transparency, consistent communication, and joint efforts to mend the relationship are crucial.

Remember, addressing financial infidelity requires patience, understanding, and a genuine desire to work things out. Just like financial investments, rebuilding trust takes time.

In conclusion, financial infidelity is a foe that can sneak into any relationship. But with open conversations, mutual respect, and a dash of humor, you can navigate the stormy seas of money matters without capsizing your love boat. Cheers to a financially honest, transparent, and blissful partnership!

Yup, you guessed it. Sometimes I throw in those magical affiliate links that can whisk you away to credit utopia. But wait, there’s more! Each time you click on one of these bad boys and decide to snag a deal, a tiny trumpet-playing squirrel delivers a small bag of gold coins to our castle. In other words, I might earn a little something-something. Just know that I would never use a link that I don’t personally use myself and/or highly recommend.