Hey there, savvy readers! Grab a seat if you’ve ever dreamt of a life unburdened by the weight of debt. I’m about to introduce you to a financial strategy that’s not just effective – it’s an absolute avalanche of awesomeness!

We’re diving headfirst into the world of the Avalanche Method. This debt pay-down plan will have you conquering your debt like a financial superhero. So, buckle up and get ready to unleash your inner debt dominator!

What’s the Snowball Method and How Does It Compare?

Before we leap into the Avalanche Method, let’s nod to its well-known sibling, the Snowball Method. Imagine your debts as a collection of small, giant snowballs scattered across a snowy landscape.

The Snowball Method advises tackling the smallest snowball first while making minimum payments on the rest. As you knock out the smaller debts, you roll the payments you made into the next more giant snowball, creating a snowball effect that gains momentum over time.

Don’t get me wrong – the Snowball Method is like a snow globe of success. It gives you quick wins and a psychological boost as you wipe out smaller debts. But there’s a method that goes a step further, where the Avalanche Method enters the scene with a roar!

The Mighty Avalanche Method Unveiled

Imagine standing at the base of a financial mountain, and your debts are boulders tumbling down.

The Avalanche Method first targets the highest interest rates, regardless of the debt size.

Think about aiming your financial snowballs at the most financially flammable spots. You’re attacking where it hurts the most – your wallet!

Here’s the drill:

- List Your Debts: Get your financial house in order by listing all your debts. From credit cards to student loans, line them up like soldiers in formation.

- Interest Rates in the Spotlight: Identify the interest rates on each debt. The debt with the highest interest rate takes center stage – it’s the top target for your debt-decimating plan.

- Minimums for All: Pay the minimum amount required on all your debts. Keep the creditors at bay while you unleash the avalanche.

- Attack the Beast: Throw every extra dollar you can muster at the debt with the highest interest rate. Channel your inner warrior and bombard it with payments until it crumbles.

- Celebrate And Move On: With the highest-interest debt conquered, move to the next target. Rinse and repeat until you’ve obliterated every debt in your path!

The Avalanche Advantage

Now, I know what you’re thinking. “Hey, isn’t the Snowball Method a bit more fun? Quick wins and all that jazz?”

Well, here’s the twist – the Avalanche Method might not give you the instant gratification of the snowball. Still, it’s like planting a money tree in the long run.

Picture this: You have a credit card with a 20% interest rate, a small balance, and another with a 10% rate but a larger one.

With the Snowball Method, you’d attack the small-balance card first.

But guess what?

The bigger-balance card at 10% costs you more in the long haul. The Avalanche Method smacks that high-interest debt out of the park, saving you more money over time. It’s like choosing a steak dinner over fast food – the wait is worth it!

Living Paycheck to Paycheck? The Avalanche Method Has Your Back!

Now, let’s talk about the real world. What if you’re juggling bills, living paycheck to paycheck, and tackling high-interest debts seems as feasible as flying to the moon in a cardboard box?

Fear not, because the Avalanche Method has strategies that even a financial tightrope walker can pull off!

- Budget with a Scalpel, Not a Sledgehammer: Scrutinize your monthly expenses like a detective on a hot case. Trim the fat – that means cutting down on non-essentials like that fancy coffee that costs more than your utility bill!

- Create an Emergency Cushion: Build a small emergency fund before you unleash the avalanche. Even $500 can save you from falling back into high-interest debt when life throws a curveball.

- Negotiate Like a Pro: Call your creditors and negotiate lower interest rates. It’s like haggling at a bazaar – you might snag a better deal!

- Side Hustle Hustle Hustle: Explore side gigs that can bring in extra cash. From freelancing to pet-sitting, there are countless ways to boost your income.

- Micro-Payments Rule: Even if it’s just a few bucks, send in extra payments whenever possible. It’s like throwing pebbles at the debt mountain – they’ll add up over time.

A Real-Life Example that Packs a Punch

Let’s dive into the nitty-gritty with an example.

Meet Lisa, a graphic designer battling a credit card debt avalanche. She’s got two credit cards – one with a $3,000 balance at 18% interest and another with a $5,000 balance at 12% interest.

Lisa decided to tackle her debt with the Avalanche Method. She makes minimum payments on both cards, which amount to $150. She scours her budget and squeezes out an extra $100 monthly for debt elimination.

Lisa targets the 18% interest card first. With her minimum payment of $150 plus the extra $100, she slams $250 into that card monthly. In just over a year, Lisa crushed that debt like a pro. Now, she takes the $250 she was throwing at the first card and adds it to the minimum payment of $120 on the second card, resulting in a whopping $370 monthly avalanche!

When Lisa conquers the second card, she’s roaring down the mountain of debt with an extra $370 monthly. That’s $4,440 a year that she’s no longer shackled to high-interest payments! Go Lisa, Go Lisa, Go!

In Conclusion: Avalanche Your Way to Financial Freedom

So, dear readers, as we bid adieu, remember this – the Avalanche Method is like a superhero cape for your finances. It’s the intelligent, strategic way to knock out high-interest debts and save you a bundle in the long run. Whether living paycheck to paycheck or swimming in cash, this method is your secret weapon to achieving a debt-free life.

As the credit expert in the room, I implore you to give the Avalanche Method a whirl. Take those high-interest debts head-on and watch them crumble like a house of cards in a gust of financial wisdom. With budgeting finesse, negotiation charm, and the determination to crush your debt, you’ll be on the path to financial freedom faster than you can say, “Adios, debts!”

Now, my debt-demolishing comrades, go forth and unleash the Avalanche Method upon your debts. The journey might have ups and downs, but remember, the view from the debt-free summit is breathtaking.

Happy debt-crushing!

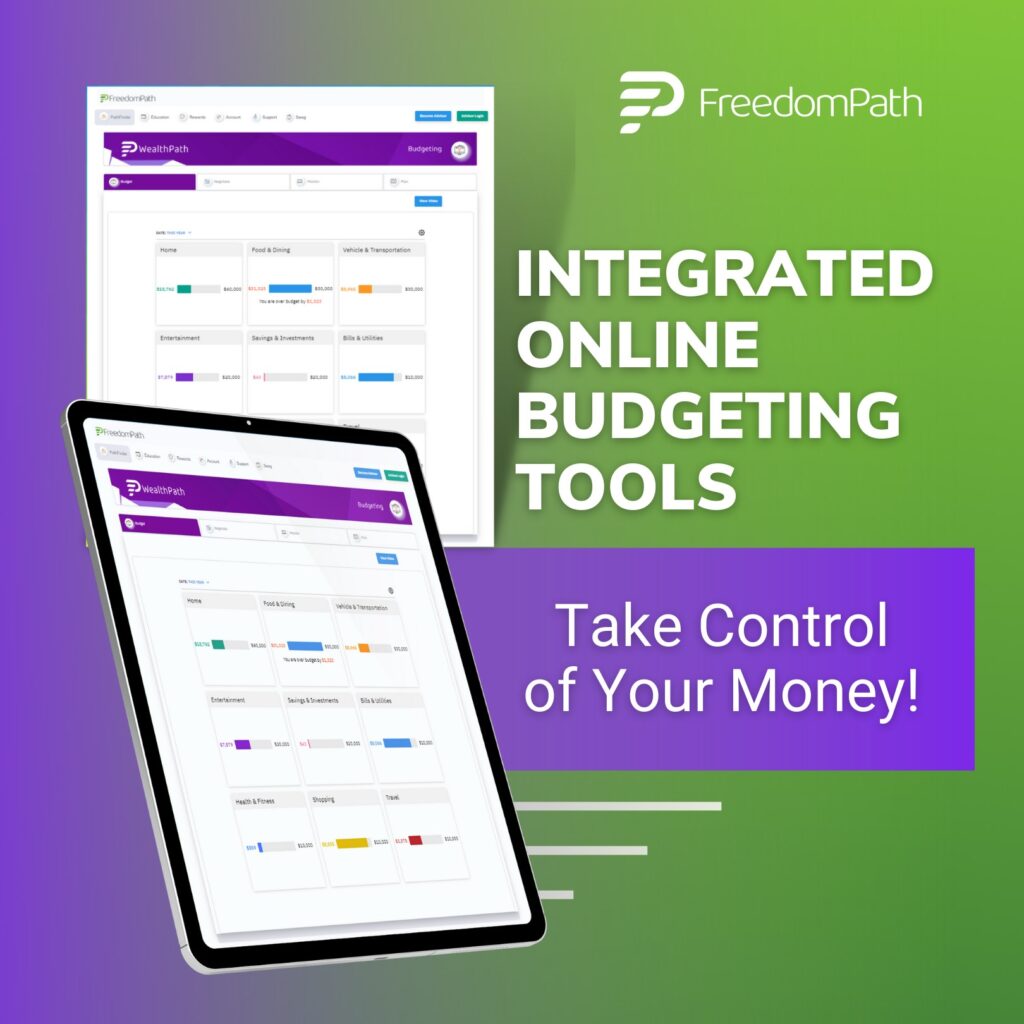

Need help budgeting like a pro? FreedomPath helps you keep your financial affairs in order, with an abundance of calculators to help you budget like you never have before!

Yup, you guessed it. Sometimes I throw in those magical affiliate links that can whisk you away to credit utopia. But wait, there’s more! Each time you click on one of these bad boys and decide to snag a deal, a tiny trumpet-playing squirrel delivers a small bag of gold coins to our castle. In other words, I might earn a little something-something. Just know that I would never use a link that I don’t person