Unlocking the Mysteries of Credit Protection with a Dash of Wit

Ahoy, savvy readers and financially conscious wanderers! In the tempestuous sea of personal finance, two formidable tools emerge as your trusty anchors: the Credit Freeze and the Fraud Alert.

Imagine them as the guardians of your treasure chest, ensuring that only you and your parrot have access to the glittering jewels within.

But ah, what distinguishes these stalwart defenders?

Fear not, for I, your friendly credit expert, shall illuminate this murky trail with the beacon of knowledge, sprinkled with humor and insight.

Introduction to Our Guardians

Picture this: You’ve been pillaging the financial world, swiping your credit card like a modern-day pirate. Suddenly, news reaches you of a breach in the financial castle walls, putting your precious doubloons at risk. This is where the credit freeze and the fraud alert ride in on their trusty steeds.

A credit freeze is like casting a spell on your credit report. It locks it up in a formidable fortress, and even the mightiest of financial pirates would need a secret code to access it. This means no new credit accounts can be opened in your name – no ship sets sail without your permission.

On the other hand, a fraud alert is more like raising a flag to warn the fleet of potential danger. When you set up a fraud alert, lenders are advised to scrutinize any application that bears your name. It’s like putting a “Beware of Dog” sign, but for your financial identity.

Credit Freeze: The Impenetrable Fortress

Let’s walk the plank into the depths of the credit freeze, shall we?

When you freeze your credit, it’s like erecting a fortress around your credit report. No one, not even you, can access it unless you thaw it out. So, if Blackbeard himself tried to open a new credit line in your name, he’d be denied faster than you can say “avast.”

Imagine you’ve been treating yourself to some online shopping (a treasure hunt of sorts), and you’re concerned about potential cyber sharks.

You decide to freeze your credit. Any would-be scallywag trying to open a credit account will be met with the icy silence of your frozen credit, rendering their efforts futile.

But here’s the twist: When you’re ready to apply for credit yourself, you’ll need to thaw your credit temporarily. You’ll provide the secret code (or PIN) you received when you initially froze it, allowing lenders to check your credit report. Then, when your adventure is complete, your credit goes back into its icy slumber.

Fraud Alert: The Sentinel of Caution

Now, onto the loyal watchdog known as the fraud alert. This is like sending word to your lookout crow to watch for any marauders. When you set up a fraud alert, the credit bureaus notify lenders that they should tread carefully before approving any applications in your name.

Let’s say you receive a carrier pigeon bearing news of a data breach at a financial institution you’ve been dealing with. You wisely suspect that your personal information might be floating around the dark corners of the web.

Time to set up a fraud alert!

With this alert in place, any creditor who receives an application bearing your name will have to take additional steps to verify your identity.

However, unlike the credit freeze, you retain the ability to freely access your credit reports. No need for secret codes or thawing rituals. Just remember to renew the alert every 90 days if you want it to keep its vigilant eyes peeled.

When to Call Upon Our Guardians

Ah, the million doubloon question: When should you unfurl the credit freeze flag or let the fraud alert raven take flight?

- Credit Freeze: Picture this, you’ve unearthed the treasure map of your credit report and spotted discrepancies – accounts you never opened, debts you never plundered. A credit freeze is your sabre-wielding defense. It prevents new accounts from being opened without your consent, safeguarding your financial ship from cannon fire.

- Fraud Alert: Suppose you’re sailing along merrily, but then the wind carries whispers of a data breach at a company you do business with. You don’t spot any oddities on your credit map, but you want to be ready for any potential ripples. Hoist the fraud alert flag to raise awareness among lenders, signaling them to be cautious when reviewing applications with your name.

Captain’s Orders! Making the Choice

Now, the ultimate question: Which strategy suits you best, oh master of your financial destiny?

- Credit Freeze: Choose this mighty sword if you’ve been a victim of identity theft before or if you prefer the ironclad security of keeping all new credit at bay. Beware though – while it thwarts pirates, it also means a bit of extra effort when you want to open new accounts yourself.

- Fraud Alert: Opt for the raven’s watch if you’re not in the mood to lock down your credit entirely. This strategy lets you keep tabs on your credit while allowing new credit openings – just with an extra layer of scrutiny. Perfect if you’re not in the mood for a full-fledged credit freeze.

Conclusion – Charting Your Course to Safety

There you have it, intrepid sailors of financial waters! The credit freeze and the fraud alert: two distinct yet equally valiant defenders of your credit treasure. One, a frozen fortress against all invaders, the other, a watchful sentinel scanning the horizon for approaching danger.

So, whether you choose the impenetrable credit freeze to lock down your financial citadel or the vigilant fraud alert to warn of potential stormy seas, remember this: protecting your credit is not just about defending your doubloons, but safeguarding your financial legacy. Set sail, armed with knowledge, and may the winds of financial fortune ever be in your favor!

Yup, you guessed it. Sometimes I throw in those magical affiliate links that can whisk you away to credit utopia. But wait, there’s more! Each time you click on one of these bad boys and decide to snag a deal, a tiny trumpet-playing squirrel delivers a small bag of gold coins to our castle. In other words, I might earn a little something-something. Just know that I would never use a link that I don’t personally use myself and/or highly recommend.

About the Author

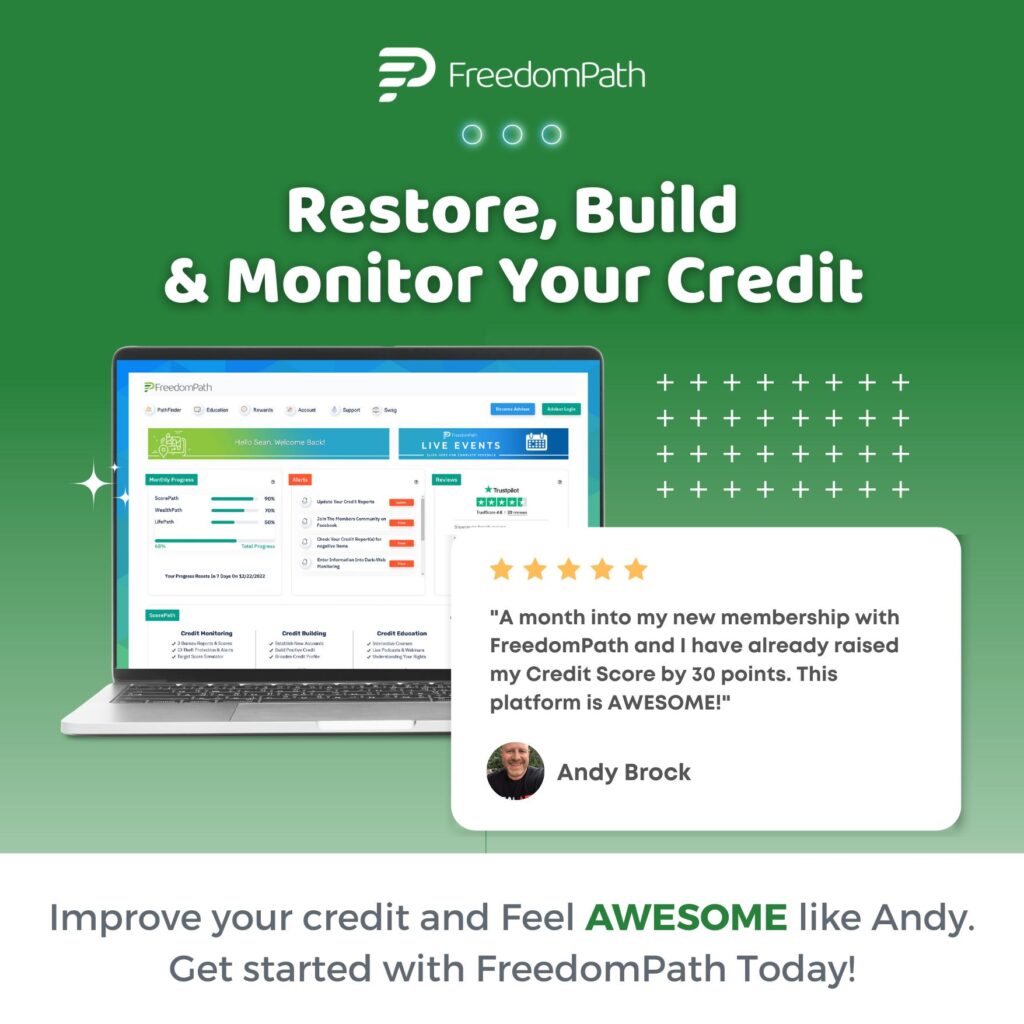

Meet Ashley Effinger, the Credit Queen👑 and FreedomPath Advisor! Digital marketing royalty, I’m all about conversions and changing lives! 💪🏾 By day, I improve credit scores, learn budgeting tricks, and build lasting wealth with my guidance. By night, I’m a rockstar wife and a supermom of 5 amazing kiddos!🌟 When not slaying credit myths, I indulge in my passions: reading, jet-setting, and sipping smoothies!📚✈️🍹 Follow me for credit tips and a dose of laughter! 😄