Sometimes we throw in those magical affiliate links that can whisk you away to credit utopia. Each time you click on one of these bad boys and decide to snag a deal, a tiny trumpet-playing squirrel delivers a small bag of gold coins to our castle. In other words, we might earn a little something-something.

Want to Build Credit? Here’s How!

Ready to level up your credit game? Here’s the lowdown on how to build credit like a pro.

First things first, open up your own credit card. It’s like having a magical plastic key to financial opportunities. Plus, you’ll look super cool pulling it out at the register.

But wait, there’s more! You can also become an authorized user on someone else’s credit card. It’s like hitching a ride on their credit-building train. Just make sure you’re on good terms with them, or things could get awkward.

And if you want to boost your credit power even more, whip out a credit-builder loan. It’s like flexing your financial muscles and showing lenders you mean business.

Now, you might be thinking, “Why do I even need credit?” Well, my friend, let me tell you.

Picture this: you’re in the market for a sweet new ride or a cozy home, but you’re lacking the cash to make those dreams a reality. That’s where credit comes in clutch.

When businesses need to size you up and figure out if you’re creditworthy, they turn to your credit reports and scores.

It’s like your financial resume, and a good score means you’ll get better deals and perkier terms.

The Secret Sauce for Good Credit?

So, what’s the secret to a killer credit score?

It’s all about how you’ve handled debt in the past. Were you rocking those on-time payments and bossing your debt like a champ? Then you’re on track for a golden score.

But if you’ve got some skeletons in your credit closet – like late payments or not much credit experience at all – getting approved for new accounts can be tough. And if you do get the green light, you might end up with some not-so-great terms.

Credit: It’s Not Just for Credit Cards!

You don’t need a credit card to build credit. In fact, there are plenty of other ways to boost your credit score and show lenders that you’re reliable.

Here are four strategies you can use:

1. Pay off your loans like a champ: Your payment history is key to your credit score, so make sure you’re paying all your loans diligently. Pay on time and in full to maintain a good payment history. Plus, making progress on paying down your loans shows lenders that you’re responsible with your debts.

2. Get an installment loan: If you don’t have much credit history, an installment loan can give your score a boost. Whether it’s a car loan, mortgage, personal loan, or student loan, paying it off on time can help you build credit. Just make sure you’re not taking out a loan just for the sake of building credit.

3. Join a lending circle: Want to build credit while helping others? Join a lending circle, where you and your peers lend to each other. The Mission Asset Fund is one organization that facilitates this type of borrowing and credit-building.

4. Include your monthly bills: Did you know your cell phone and utility bills could help build your credit? You can have them added to your credit report through the FreedomPath platform. This way, your on-time payments can be reflected in your credit score instantly.

5. Limit the hard inquiries: Stop! Before you go on a credit application spree, listen up. Submitting a bunch of credit applications in a short period of time can seriously mess with your credit score. I’m talking about those little things called hard inquiries, or as I like to call them, hard pulls. They stick around on your credit report for up to two years and can knock a few points off your credit score. Ouch!

But don’t stress just yet, because not all credit checks are created equal. There are these cool things called soft inquiries that don’t actually impact your credit score.

They’re the inquiries made by potential employers, auto insurers calculating your fancy premiums, or even credit card companies trying to woo you with pre-approval offers.

So, to sum it up: limit the hard inquiries, give the soft ones a pass, and keep your credit score in tip-top shape. Trust me, you’ll thank me later.

But what if you have no credit history at all?

Don’t worry, there are still options:

– Ask someone with good credit to add you as an authorized user or help you get a loan. This will give you a head start in building your credit.

– Look for credit accounts specifically designed for people new to credit. Credit-builder loans from community banks or credit unions can help you establish credit.

Think of it as a magic trick that shows lenders your awesome payment history and introduces installment credit to your credit mix. It’s like turning into a credit superhero!

Here’s how it works: when you make the final payment on this loan, the bank or credit union releases the cash you used as security. It’s like unlocking the treasure chest of good credit!

Oh, and the best part? No annual fees, my friend!

Plus, it’s a fantastic way to build and diversify your consumer credit. Who knew building credit could be so exciting?

But wait, there’s more! CreditStrong, the national leader in this space, offers both revolving and installment credit options. They’ve got your back, and here’s the cherry on top: no hard credit pull when you open an account with them.

– Make sure the lender reports your account and payment history to the credit bureaus.

Get to Know the Types of Credit

Credit can be confusing, but don’t worry, I’ve got you covered.

There are three main types of credit you’ll encounter:

- revolving credit (credit cards and lines of credit)

- installment credit (loans)

- service credit (monthly bills).

Each one plays a role in your credit reports and scores.

How to Build Credit Rapidly

Now, let’s talk about building credit fast. It’s not easy, but there are a couple of tricks.

First, improve your credit utilization by paying down your credit card balances. If possible, ask your lender to increase your credit limit.

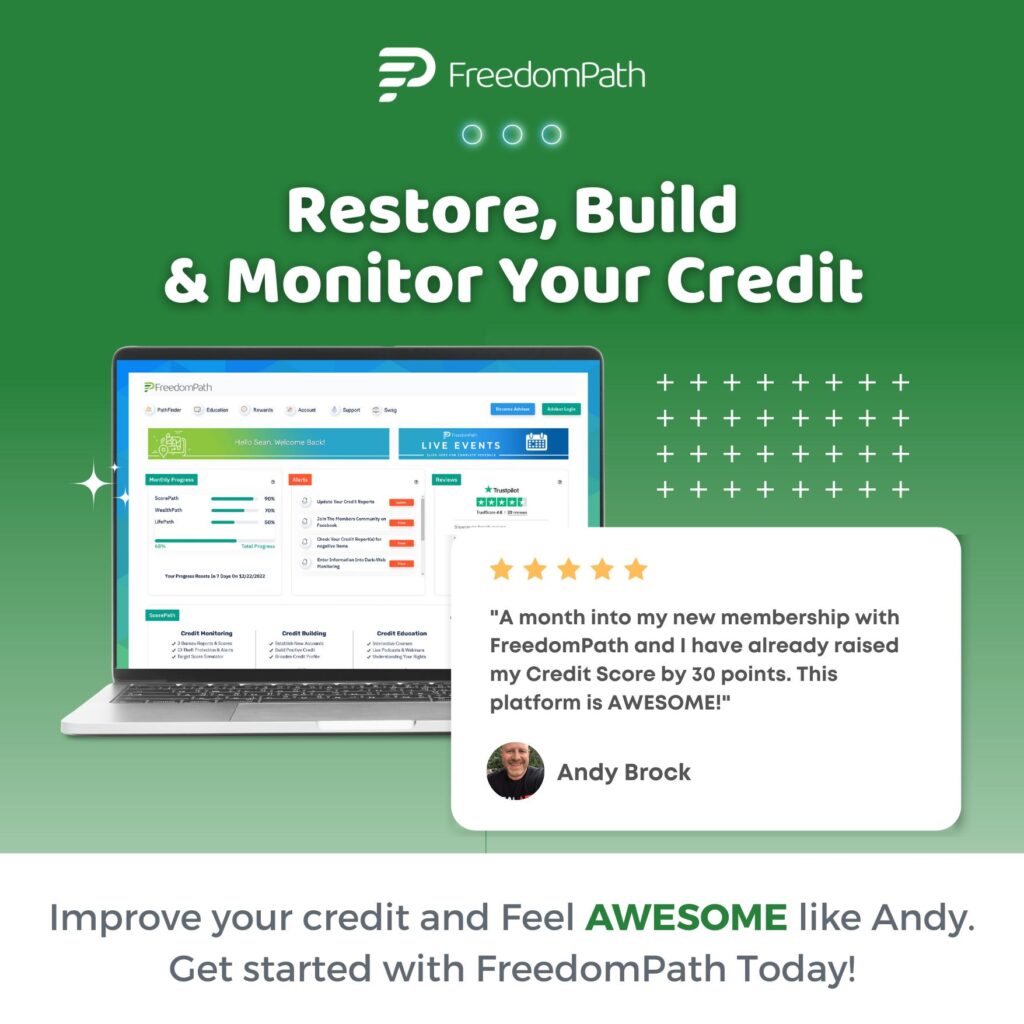

And here’s a secret weapon: FreedomPath. This amazing platform connects with the credit bureaus to reward you for on-time payments. According to Experian, it can instantly boost your credit score by as much as 13 points!

Consistency is key when it comes to building credit.

Stick to good habits and monitor your credit score regularly.

Keep an eye on your:

- payment history

- credit utilization

- types of credit accounts

- length of credit history

- debt balances

- bankruptcies

- recent credit applications

All these factors influence your credit scores.

Feeling overwhelmed?

Don’t worry, there’s help available. Educate yourself on credit through the Credit Queen’s blog.

Consider seeking guidance from a credit counselor who can help you navigate through debt and improve your credit scores.

Avoid these financial mistakes that wreak havoc on your scores!

Forget budgeting?

Say hello to missed payments and a sinking credit score. Set a budget, stick to it, and watch your financial obligations become a piece of cake.

Guard your personal info like a secret agent

Hackers and identity thieves can spell disaster for your credit. Use strong passwords and only share your info when necessary. Don’t let the bad guys use your identity to open bogus accounts!

Pump the brakes on those credit card applications

Applying for credit cards like a maniac sends a red flag to lenders. Plus, each application means a hard inquiry on your credit report. Limit those inquiries and do your research before hitting that apply button.

And regardless of whether you’re starting from scratch or on the rebound, keep a close eye on your credit. Sign up for FreedomPath and you’ll receive a credit monitoring tool to watch your progress at no additional charge.

Plus, get a free copy of your credit reports and scores at AnnualCreditReport.com.

Now that you know the basics of how credit works, it’s time to start building your credit and reaping the rewards of good financial management.

Now, I won’t lie, building up credit takes time. It’s not an overnight miracle. But with the right strategies and a little bit of humor, you’ll be on your way to financial greatness!

Trust me, the benefits are worth it. Even if you don’t plan on swiping plastic anytime soon, start building that credit empire now. Your future self will thank you.

So go out there and show lenders you can handle debt like a pro! With these tips, you’ll be on your way to credit success in no time!

Yup, you guessed it. Sometimes I throw in those magical affiliate links that can whisk you away to credit utopia. But wait, there’s more! Each time you click on one of these bad boys and decide to snag a deal, a tiny trumpet-playing squirrel delivers a small bag of gold coins to our castle. In other words, I might earn a little something-something. Just know that I would never use a link that I don’t personally use myself and/or highly recommend.

About the Author

Meet Ashley Effinger, the Credit Queen and FreedomPath Advisor! Digital marketing royalty, I’m all about conversions and changing lives! By day, I improve credit scores, learn budgeting tricks, and build lasting wealth with my guidance. By night, I’m a rockstar wife and a supermom of 5 amazing kiddos! When not slaying credit myths, I indulge in my passions: reading, jet-setting, and sipping smoothies! Follow me for credit tips and a dose of laughter!

Drop me a line (say hi, ask a credit repair question, fan out, etc.): badcreditisexpensive@gmail.com

Ready to get started fixing YOUR credit? ashley@mycreditqueen.com

Let’s Connect on  Social

Social

LinkedIn: Ashley Effinger

Pinterest: @badcreditisexpensive

Instagram: @badcreditisexpensive

Youtube: @BadCreditIsExpensive

Twitter: @creditqveen

Facebook: @badcreditisexpensive

TikTok: @badcreditisexpensive

Medium: Ashley Effinger | Subscribe

[…] It’s not easy, but it’s definitely doable. A little over 1% of people ever reach that perfect 850 score, but with some dedication, you can get pretty close. The key is paying your bills on time, reducing your debt (except for your mortgage), and keeping your credit ut…. […]

It is really a great and helpful piece of info. I抦 glad that you shared this helpful information with us. Please keep us informed like this. Thank you for sharing.