Ready to achieve the highest credit score and take your finances to the next level?

It may seem daunting, but getting that perfect 850 FICO score is actually possible. Let me break it down for you in a way that’s easy to understand.

Your FICO score is the golden ticket that financial institutions use to determine whether to lend you money or issue a credit card.

And guess what?

You don’t just have one score, but three!

Each of the major credit bureaus – Experian, TransUnion, and Equifax – provides a different FICO score based on their report.

But here’s the catch: your main FICO score is the one that matters. It’s the average of the three credit bureau scores, which can vary slightly.

So those numbers like 730, 750, and 780?

They add up to a FICO score of 750. Make sure to keep an eye on your credit reports because those numbers can make a big difference!

Credit Scores: How Perfect is Perfect?

You might think that people with perfect credit scores don’t have any debt, but that’s not entirely true.

They do owe money, but they handle it differently than the rest of us.

They have more credit products and more credit cards than the average person, but they owe less.

In fact, those with a perfect 850 FICO Score owe less than half of what the average American owes. The national average debt is $5,221, but these credit score rockstars only owe $2,558 on average.

But here’s the interesting part: even though they owe less overall, they actually have more debt in certain areas compared to the general population.

For example, their personal loan balances are almost double the average, with an average balance of $32,872 compared to $17,064.

So while they’re winning in some areas, they’re also carrying a heavier load in others.

What Do Your Credit Scores Really Mean?

Credit scores are a big deal for lenders, as they provide a snapshot of your credit history. Here’s a breakdown of how different FICO Scores are viewed by lenders:

- Exceptional: 800 to 850. This range is considered exceptional, leading to easy approval and the best terms on new credit. Think low interest rates and fees galore!

- Very good: 740 to 799. Falling in this range means you’ve got a very good credit score. You could qualify for better interest rates and impress lenders.

- Good: 670 to 739. Don’t worry, the average U.S. credit score falls in this range. It’s considered good, making you an “acceptable” borrower. You’ll have access to a wide range of loans and credit cards, although interest rates might be a bit higher.

- Fair: 580 to 669. This range is fair, but lenders may be hesitant to approve you for mainstream loans. You could be seen as a subprime borrower, which means higher interest rates.

- Poor: 300 to 579. With a credit score in this range, lenders will likely decline your application. It could be due to bankruptcy or major credit issues. You might only qualify for secured credit cards or have to pay substantial security deposits for utilities.

Now, let’s talk ranges.

FICO scores range from 300 to 850.

Anything above 670 is considered good, but if you want to be exceptional, aim for the 800 to 850 range. That’s where the real magic happens.

But hey, FICO isn’t the only player in town.

They have different versions of their scoring models, like the recently developed FICO 10.

Mortgage lenders tend to stick to the older versions. And there are industry-specific FICO scores too, depending on what you’re applying for.

What generation is dominating the perfect 850 credit score?

Guess who’s most likely to have a perfect FICO Score?

According to Experian It’s none other than the wise and experienced baby boomers and the silent generation at a little over 73%!

These OGs dominate the scene with the vast majority of them rocking an impressive 850 FICO Score.

Meanwhile, the younger folks of Generation X, millennials, and Generation Z make up just a measly 27% of the perfect score club. Looks like age really does come with some perks when it comes to creditworthiness!

Now, how do you actually get that highest credit score?

It’s not easy, but it’s definitely doable. A little over 1% of people ever reach that perfect 850 score, but with some dedication, you can get pretty close.

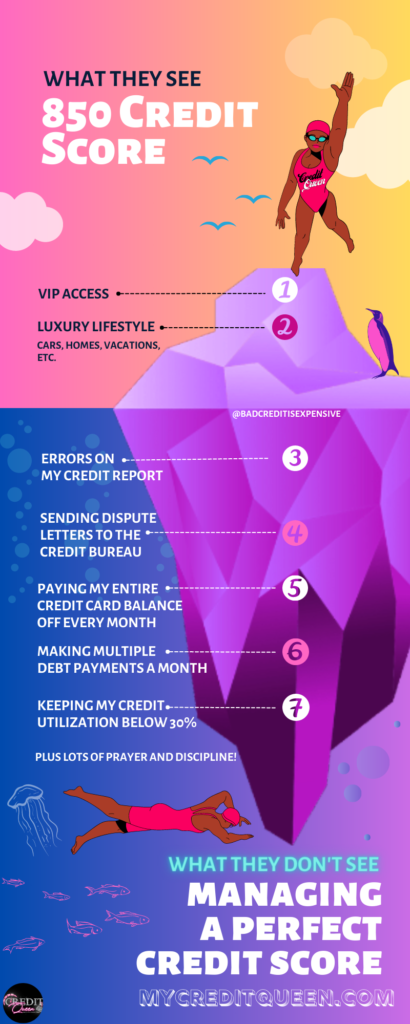

The key to a perfect credit score is paying your bills on time (or early), reducing your debt (except for your mortgage) and keeping your credit utilization ratio low.

But hang on, there are a few things you need to be cautious about.

Balance transfers, closing credit cards, and having too many accounts can actually hurt your credit score.

And if you have some annoying negative marks on your report, DIY credit repair might be able to help, for a nominal fee.

So how many people actually have exceptional credit scores?

Well, about 21% of consumers fall into that “exceptional” category with scores between 800 and 850.

Another 25% have “very good” scores, while 21% have “good” scores.

The rest have fair or very poor credit scores.

Wondering how to raise your credit score fast?

- You can try enrolling in programs like FreedomPath to have other factors like utility bills or rent payments affect your score.

- Correcting errors on your credit report can also have a quick impact.

But in general, paying off debts and making payments on time are the tried-and-true methods.

Remember, different lenders have different criteria, but generally, a score above 670 is considered good.

So aim high and watch those loan terms get better and better.

Moral of the Story

Guess what?

You have the power to rock a flawless credit score!

When your score reaches a mighty 780 or more, lenders will view you as the cream of the crop, the lowest risk borrower in town.

And boy, oh boy, do they love that!

You’ll score the sweetest interest rates, snag the best product offers, and have pretty much guaranteed approval for any loan that suits your income. Cha-ching!

But don’t just sit back and soak in your credit score glory.

Keep an eye on it, keep nurturing it, and keep climbing that ladder to credit perfection.

Monitor your credit score like a boss and work to improve it, all while getting free access to your credit score or report. It’s a win-win, baby!

Conclusion

In conclusion, having a perfect credit score doesn’t mean you’re debt-free, but it does mean you’re managing your finances in a unique and impressive way.

So if you’re striving for that perfect 850, just remember that it’s not all about the numbers, it’s about how you navigate the credit game. Keep up the good work, credit score superstar!

Now go out there and conquer that credit score game. You got this!

Sometimes I throw in those magical affiliate links that can whisk you away to credit utopia. Each time you click on one of these bad boys and decide to snag a deal, a tiny trumpet-playing squirrel delivers a small bag of gold coins to my castle. In other words, I might earn a little something-something. I’m super grateful for your support!